UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

|

|

|

☒

|

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material under §240.14a-12

|

LOWELL FARMS INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the

Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and

0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction

applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction

applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was

determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange

Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by

registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

LOWELL FARMS INC.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

OF LOWELL FARMS INC.

AND

PROXY STATEMENT

FOR ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON SEPTEMBER 21, 2021

August 27, 2021

LOWELL FARMS INC.

Notice of Annual General Meeting of Shareholders (the

“Notice”)

The

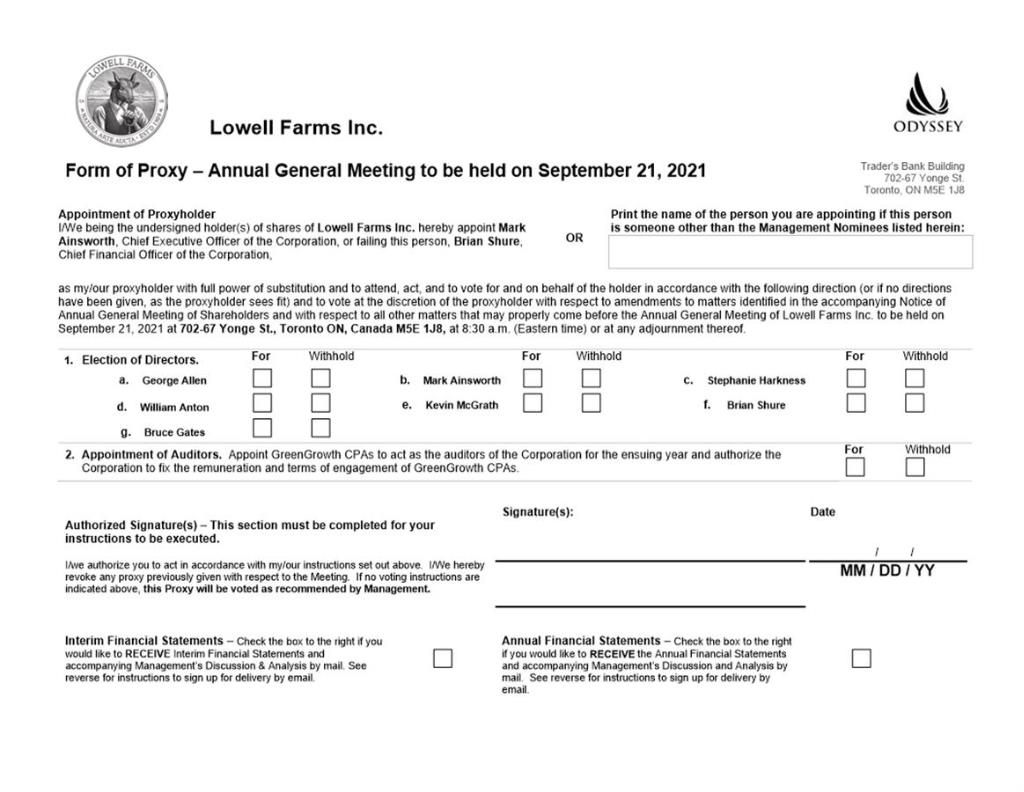

2021 annual general meeting of shareholders (the

“Meeting”) of

Lowell Farms Inc., a British Columbia corporation (the

“Corporation” or

the “Company”),

will be held on September 21, 2021, beginning at 8:30 a.m. (Eastern

Time), at Odyssey Trust Company,

67 Yonge St., Suite 702, Toronto, Ontario, M5E IJ8. This

Notice of Meeting is accompanied by the proxy statement and form of

proxy (“Proxy

Instrument”).

The

following matters will be considered at the Meeting:

●

the election of seven directors for the forthcoming

year from the nominees proposed by the Board of the

Corporation;

●

the appointment of GreenGrowth CPAs, as auditors

for the Corporation and the authorization of the board of directors

of the Corporation (the “Board”) to fix the auditors’ remuneration

and terms of engagement; and

●

the

transaction of such other business as may properly come before the

Meeting or any adjournment(s) thereof.

The

record date for the determination of shareholders of the

Corporation entitled to receive notice of and to vote at the

Meeting or any adjournment(s) thereof is July 30, 2021 (the

“Record Date”).

Shareholders of the Corporation whose names have been entered in

the register of shareholders of the Corporation at the close of

business on the Record Date will be entitled to receive notice of

and to vote at the Meeting or any adjournment(s)

thereof.

A

shareholder of the Corporation may attend the Meeting or may be

represented by proxy. Registered shareholders of the Corporation

who are unable to attend the Meeting or any adjournment(s) thereof

are requested to date, sign, and return the accompanying Proxy

Instrument for use at the Meeting or any adjournment(s)

thereof.

To be

effective, the enclosed Proxy Instrument must be returned to the

Corporation’s transfer agent by using the envelope provided

or by mailing the Proxy Instrument to Odyssey Trust Company, 67

Yonge St., Suite 702, Toronto, Ontario, M5E 1J8 (Attention: Proxy

Department). You may also vote on the internet by going to

https://odysseytrust.com/login/,clicking on VOTE and following the

instructions. You will need your control number located on the

Proxy Instrument. If you wish to vote on the internet, you must do

so no later than September 17, 2021 at 8:30 a.m. (Eastern Time). If

you vote prior to the Meeting using any other method, your Proxy

Instrument must be received by Odyssey Trust Company no later than

September 17, 2021 at 8:30 a.m. (Eastern Time). If the Meeting is

adjourned, your proxy or voting instructions must be received at

least 48 hours before the beginning of any adjournment(s) or

postponement(s) of the Meeting.

If you

are a non-registered shareholder (for example, if you hold shares

of the Corporation in an account with a broker or another

intermediary), you should follow the voting procedures described in

the form of proxy or voting instruction form provided by your

broker or intermediary or call your broker or intermediary for

information as to how you can vote your shares. Without specific

instructions, brokers and their agents and nominees are prohibited

from voting shares for the broker’s clients. Therefore, each

non-registered shareholder should ensure that voting instructions

are communicated to the appropriate person well in advance of the

Meeting. Note that the deadlines set by your broker or intermediary

for submitting your form of proxy or voting instruction form may be

earlier than the dates described above.

You may also vote you shares in person at the Meeting. If you are a

non-registered shareholder, you may not vote your shares at

the Meeting, or any adjournment(s) or postponement(s) thereof,

unless you obtain a legal proxy from the registered holder of the

shares giving you the right to do so.

Whether

or not you plan to attend the Meeting, we encourage you to read

this proxy statement and

promptly vote your shares. For specific instructions on how

to vote your shares, please refer to the section entitled

“How You Can

Vote” and to the instructions on your proxy or voting

instruction card.

|

|

|

DATED as of August 27, 2021

By Order of the Board of Directors

|

|

|

|

/s/

George Allen

|

|

George Allen

|

|

Chairman

|

TABLE OF CONTENTS

PROXY STATEMENT FOR THE 2021 ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON SEPTEMBER 21, 2021

This

proxy statement contains information about the 2021 annual general

meeting of shareholders (the “Meeting”) of Lowell Farms Inc., to

be held on September 21, 2021, beginning at 8:30 a.m. (Eastern

Time), at Odyssey Trust Company,

67 Yonge St., Suite 702, Toronto, Ontario, M5E IJ8. The

board of directors (the “Board”) is using this proxy

statement to solicit proxies for use at the Meeting. Unless the

context otherwise requires, references to “we,” “us,” “our,” “Company,” “Corporation,” “Lowell Farms,” or similar terms

refer to Lowell Farms Inc. The mailing address of our principal

executive offices is 19 Quail Run Circle, Suite B, Salinas,

California 93907.

All

properly submitted proxies will be voted in accordance with the

instructions contained in those proxies. If no instructions are

specified, the proxies will be voted in accordance with the

Board’s recommendation for each of the matters outlined in

the accompanying Notice of Meeting.

A

shareholder whose shares are directly registered on the books of

the Corporation maintained by the transfer agent

(“Registered

Shareholder”) of the Corporation who has given a proxy

may revoke the proxy at any time prior to use by: (i) attending the

Meeting and voting in person; (ii) depositing an instrument in

writing executed by such Registered Shareholder or by his or her

attorney authorized in writing, or, if the Registered Shareholder

is a corporation, by an authorized officer or attorney thereof: (a)

at the registered office of the Corporation at any time prior to

5:00 p.m. (Eastern Time) on the last business day preceding the day

of the Meeting or any adjournment(s) of the Meeting; or (b) with

the Chair of the Meeting on the day of the Meeting or any

adjournment(s) or postponement(s) thereof; or (iii) any other

manner permitted by law.

We

mailed this proxy statement and our annual report for the fiscal

year ended December 31, 2020 (“Annual Report”), to shareholders

on or about August 27, 2021.

We are

an “emerging growth company” under applicable U.S.

federal securities laws and, therefore, permitted to conform with

certain reduced public company reporting requirements. As an

emerging growth company, we provide in this proxy statement the

scaled disclosure permitted under the U.S. Jumpstart Our Business

Startups Act of 2012 (the “JOBS Act”). In addition, as an

emerging growth company, we are not required to conduct votes

seeking approval, on an advisory basis, of the compensation of our

named executive officers or the frequency with which such votes

must be conducted. We may take advantage of these exemptions for up

to five years or such an earlier time that we are no longer an

emerging growth company. We will cease to be an emerging growth

company if we have more than $1.07 billion in annual revenues

as of the end of a fiscal year, if we are deemed to be a

large-accelerated filer under the rules of the U.S. Securities and

Exchange Commission (the “SEC”) or if we issue more than

$1.00 billion of non-convertible debt over a three-year

period. We currently expect to cease filing as an emerging growth

company no later than January 1, 2027.

Important Notice Regarding the Availability of Proxy Materials for

the Annual General Meeting of Shareholders to be Held on September

21, 2021:

This proxy statement and our Annual Report for the fiscal year

ended December 31, 2020, are available for viewing, printing,

and downloading at: ir.lowellfarms.com

A copy of our Annual Report will be furnished without charge to any

shareholder upon written request to Mr. Steve Neil via e-mail at

steve@lowellfarms.com. This proxy statement is also available on

the SEC’s website at www.sec.gov and

on SEDAR at www.sedar.com

GENERAL INFORMATION ABOUT THE ANNUAL

GENERAL MEETING AND VOTING

Why am I receiving these materials?

The

Board is using this proxy statement to solicit proxies for use at

the Meeting to be held on September 21, 2021 at Odyssey Trust

Company, 67 Yonge St., Suite 702, Toronto, Ontario, M5E IJ8. The

cost of any solicitation will be borne by the Corporation. Proxies

may also be solicited personally by employees of the Corporation at

nominal cost to the Corporation.

As a

shareholder, you are invited to attend the Meeting and are entitled

and requested to vote on the business items described in this proxy

statement. This proxy statement is furnished in connection with the

solicitation of proxies by or on behalf of the management of the

Corporation and the Board. This proxy statement is designed to

assist you in voting your shares and includes information that we

are required to provide under the rules of the SEC and applicable

Canadian securities laws.

These

proxy materials are being sent to both registered and

non-registered shareholders. In some instances, the Corporation has

distributed copies of the Notice, the proxy statement, and the

accompanying Proxy Instrument (collectively, the

“Documents”) to

clearing agencies, securities dealers, banks and trust companies,

brokerage houses, other custodians, nominees, and fiduciaries or

their nominees (collectively “Intermediaries,” and each an

“Intermediary”)

for onward distribution to non-registered shareholders whose shares

are held by or in the custody of those Intermediaries

(“Non-Registered

Shareholders” or “Beneficial Owners”).

Existing

regulatory policy requires Intermediaries to forward all

proxy-related materials to and seek voting instructions from

Non-Registered Shareholders in advance of shareholder meetings. The

various Intermediaries have their own mailing procedures and

provide their own return instructions to clients, which should be

carefully followed by Non-Registered Shareholders in order to

ensure that their subordinate voting shares (“Shares”) are voted at the Meeting. Often

the form of proxy supplied to a Non-Registered Shareholder by an

Intermediary is identical to the form of proxy provided by the

Corporation to Registered Shareholders. However, its purpose is

limited to instructing the Registered Shareholder (i.e., the

Intermediary or agent or nominee thereof) how to vote on behalf of

the Non-Registered Shareholder. The majority of Intermediaries now

delegate responsibility for obtaining instructions from clients to

Broadridge Financial Solutions, Inc. (“Broadridge”). Broadridge typically

prepares a machine-readable voting instruction form (a

“VIF”), mails

those forms to Non-Registered Shareholders and asks Non-Registered

Shareholders to return the forms to Broadridge, or otherwise

communicate voting instructions to Broadridge (by way of the

internet or telephone, for example). Broadridge then tabulates the

results of all instructions received and provides appropriate

instructions respecting the voting of shares to be represented at a

meeting. For the purposes hereof, a Non-Registered Shareholder who

receives a Broadridge VIF cannot use that form to vote Shares

directly at the Meeting. The VIF

must be returned to Broadridge (or instructions respecting the

voting of Shares must be communicated to Broadridge) well in

advance of the Meeting in order to have the Shares

voted.

There

are two kinds of Non-Registered Shareholders: (i) those who object

to their identity being known to the issuers of securities which

they own (“Objecting

Beneficial Owners” or “OBOs”), and (ii) those who do not

object to their identity being made known to the issuers of

securities which they own (“Non-Objecting Beneficial Owners”

or “NOBOs”).

Subject to the provisions of applicable Canadian securities laws,

issuers may deliver proxy-related materials directly to their

NOBOs.

The Corporation is not sending proxy-related materials directly to

NOBOs and accordingly, NOBOs can expect to receive a scannable VIF

from Broadridge. These VIFs are to be completed and returned to

Broadridge in the envelope provided or by facsimile. In addition,

Broadridge provides both telephone voting and internet voting as

described on the VIF itself which contains complete instructions.

Broadridge will tabulate the results of the VIFs received from the

NOBOs and will provide appropriate instructions to Odyssey Trust

Company, the transfer agent of the Corporation, with respect to the

Shares represented by the VIFs they receive. Please return your

voting instructions as specified in the VIF.

The Corporation intends to pay for an Intermediary to deliver the

proxy-related materials to its OBOs and, as such, the

Corporation’s OBOs can expect to be contacted by Broadridge

or their Intermediaries or an agent or nominee

thereof.

Although

Non-Registered Shareholders may not be recognized directly at the

Meeting for the purposes of voting Shares registered in the name of

an Intermediary or an agent or nominee thereof, a Non-Registered

Shareholder may attend the Meeting as proxy holder for the

Registered Shareholder and vote its Shares in that capacity. Should

a Non-Registered Shareholder wish to attend the Meeting and

indirectly vote its Shares as proxy holder for an applicable

Registered Shareholder, such Non-Registered Shareholder should

enter its own name in the blank space on the Proxy Instrument or

VIF provided to such Non-Registered Shareholder and return same in

accordance with the instructions provided

thereon.

What is included in the proxy materials?

The

proxy materials include:

●

our proxy statement

for the Meeting;

●

a Proxy Instrument

or voting instruction card; and

●

our 2020 Annual

Report.

What information is contained in this proxy statement?

The

information in this proxy statement relates to the proposals to be

voted on at the Meeting, the voting process, our Board and board

committees, corporate governance, the compensation of our directors

and executive officers, and other required

information.

I share an address with another shareholder, and we received only

one paper copy of the proxy materials. How may I obtain an

additional copy?

If you

share an address with another shareholder, you may receive only one

set of proxy materials unless you have provided contrary

instructions. If you wish to receive a separate set of the

materials, please request the additional copy by contacting our

corporate secretary at ir@lowellfarms.com or by

calling us at (831) 998-8214.

A

separate set of materials will be sent promptly following receipt

of your request.

If you

are a shareholder of record and wish to receive a separate set of

proxy materials in the future, or if you have received multiple

sets of proxy materials and would like to receive only one set in

the future, please contact Odyssey Trust Company at:

Odyssey

Trust Company

67 Yonge St., Suite 702

Toronto, Ontario, M5E IJ8

If you

are a Beneficial Owner and wish to receive a separate set of proxy

materials in the future, or if you have received multiple sets of

proxy materials and would like to receive only one set in the

future, please contact your bank or broker directly.

Shareholders

also may write to or email us at the address below to request a

separate copy of the proxy materials:

Lowell

Farms Inc.

Attn:

Corporate Secretary

19

Quail Run Circle, Suite B

Salinas,

California 93907

ir@lowellfarms.com

Note

that you should allow more time for receipt and processing of

physical mail than under normal circumstances as the Corporation

could again become subject to “stay-at-home” or similar

orders in connection with the novel coronavirus

(“COVID-19”).

Who pays the cost of soliciting proxies for the

Meeting?

The

Corporation will bear the cost of solicitation. This solicitation

of proxies is being made to shareholders by mail but may be

supplemented by telephone or other personal contacts.

The

Corporation will reimburse Intermediaries for forwarding proxy

materials to beneficial shareholders.

What

items of business will be voted on at the Meeting?

The

business items to be voted on at the Meeting are:

●

the election of

directors for the forthcoming year from the nominees proposed by

the Board of the Corporation;

●

the appointment

of GreenGrowth CPAs as auditors for

the Corporation and the authorization of the

Board to fix the auditors’ remuneration and terms

of engagement; and

●

the

transaction of such other business as may properly come before the

Meeting or any adjournment(s) thereof.

What are my voting choices?

You may

vote “FOR” or

“WITHHOLD” for the

election of nominees for election as directors and

“FOR”

or “WITHHOLD,” for the

appointment of GreenGrowth CPAs, as auditors for the ensuing year

and the authorization of the Board to fix the auditor’s

remuneration and set the terms of engagement.

How does the Board recommend that I vote?

Our

Board recommends that you vote your shares “FOR” each

of its nominees for election to the Board and “FOR” the

appointment of GreenGrowth CPAs as auditors for the ensuing year

and the authorization of the Board to fix the auditor’s

remuneration and set the terms of engagement.

What vote is required to approve each item?

A quorum for the transaction of business at a meeting of

shareholders is present if at least two shareholders who, in the

aggregate, hold or represent in the aggregate not less than 20% of

the issued shares entitled to be voted at the meeting are present

in person or represented by proxy, irrespective of the number of

persons actually present at the meeting.

If you indicate “WITHHOLD”

in respect to the election of directors or the appointment and

remuneration of the auditors, your vote will be counted for

purposes of determining the presence or absence of a quorum for the

transaction of business at the Meeting.

Broker non-votes will be counted for determining the

presence or absence of a quorum for the transaction of business at

the Meeting, but will not be considered votes cast with respect to

the election of any director nominee or the appointment and

remuneration of the auditors.

|

Proposal

|

|

Required Vote

|

|

1. The election of directors

|

|

Ordinary resolution, whereby only votes “FOR” will

affect the outcome

|

|

|

|

|

|

2. Appointment and remuneration of auditors

|

|

Ordinary resolution, whereby only votes “FOR” will

affect the outcome

|

What happens if additional items are presented at the

Meeting?

As of

the date of this proxy statement, management of the Corporation

knows of no such amendments, variations, or other matters to come

before the Meeting. However, if other matters properly come before

the Meeting, it is the intention of the persons named in the

enclosed Proxy Instrument to vote such proxy according to their

best judgment.

Where can I find the voting results?

We

expect to announce preliminary voting results at the Meeting and to

publish final results in a current report on Form 8-K that we will

file with the SEC and in a press release that we will file in

Canada with the applicable Canadian securities commissions or

similar regulatory authorities promptly following the Meeting. Both

the Form 8-K and press release will also be available on our

website at https://ir.lowellfarms.com/.

What shares can I vote?

You are

entitled to vote all the shares that you own on the Record Date,

including (1) shares held directly in your name as the

shareholder of record and (2) shares held for you as the

Beneficial Owner through an Intermediary. As of the Record Date,

there were 154 shareholders of record holding 78,992,636 Subordinate Voting Shares and

one shareholder of record holding 202,590 Super Voting Shares.

REGISTERED SHAREHOLDERS HAVE THE RIGHT TO APPOINT A PERSON TO

REPRESENT HIM, HER OR IT AT THE MEETING OTHER THAN THE PERSON(S)

DESIGNATED IN THE PROXY INSTRUMENT either by striking out

the names of the persons designated in the Proxy Instrument and by

inserting the name of the person or company to be appointed in the

space provided in the Proxy Instrument or by completing another

proper form of proxy and, in either case, delivering the completed

proxy to the Corporation’s transfer agent by using the

envelope provided or by mailing the proxy to Odyssey Trust Company,

67 Yonge St., Suite 702, Toronto, Ontario, M5E 1J8 (Attention:

Proxy Department). You may also vote on the internet by going to

https://odysseytrust.com/login/,clicking on VOTE and following the

instructions. You will need your control number located on the

Proxy Instrument.

What is the difference between holding shares as a shareholder of

record and as a Beneficial Owner?

Shareholder of Record

If your

shares are registered directly in your name with our transfer

agent, Odyssey Trust Company, you are the shareholder of record of

the shares. As the shareholder of record, you have the right to

grant a proxy to vote your shares to representatives from the

Corporation or to another person, or to vote your shares at the

Meeting. You have received a proxy card to use in voting your

shares either by mail or via the internet.

Beneficial Owner

If your

shares are held through an Intermediary, then it is likely that

they are registered in the name of the nominee, and you are the

Beneficial Owner of shares held in street name.

As the

Beneficial Owner of shares held for your account, you have the

right to direct the registered holder to vote your shares as you

instruct, and you also are invited to attend the Meeting. Your

Intermediary has provided a voting instruction card for you to use

in directing how your shares are to be voted. However, since a

Beneficial Owner is not the shareholder of record, you may not vote

your shares at the Meeting, or any adjournment(s) or

postponement(s) thereof, unless you obtain a legal proxy from the

registered holder of the shares giving you the right to do

so.

How can I vote at the Meeting?

Shareholders

who attend the Meeting may be provided with a ballot with which

they can cast their vote or a vote may proceed by way of a show of

hands.

Even if

you plan to attend the Meeting, we recommend that you also submit

your proxy or voting instructions as described herein so that your

vote will be counted if you later decide not to

attend.

How can I vote without attending the Meeting?

Whether

you hold your shares as a shareholder of record or as a Beneficial

Owner, you may direct how your shares are to be voted without

attending the Meeting or any adjournment(s) or postponement(s)

thereof. If you are a shareholder of record, you may vote by

submitting a proxy. If you hold shares as a Beneficial Owner, you

may vote by submitting voting instructions to the registered owner

of your shares. Each registered shareholder submitting a proxy has

the right to appoint one or more proxy holders (but not more than

five) to represent the shareholder at the Meeting to the extent and

with the powers conferred by the proxy.

For

directions on how to vote, please refer to the following

instructions and those included on your proxy or voting instruction

card. A proxy form will not be valid unless completed and deposited

in accordance with the instructions set out in the proxy

form.

Voting by Internet

Shareholders

may vote over the internet by following the instructions on the

proxy or voting instruction card.

Voting by Mail

Shareholders

may vote by mail by signing, dating, and returning their proxy or

voting instruction card to the address indicated on the proxy or

voting instruction card.

How will my shares be voted?

Shares

represented by properly executed proxies in favor of persons

designated in the printed portion of the enclosed Proxy Instrument

WILL, UNLESS OTHERWISE INDICATED BY

THE SHAREHOLDER, BE VOTED FOR

THE ELECTION OF DIRECTORS

AND FOR

THE APPOINTMENT OF GREENGROWTH CPAs

AS THE AUDITORS OF THE CORPORATION, AND THE AUTHORIZATION OF THE

BOARD OF DIRECTORS TO FIX AUDITORS’ REMUNERATION AND TERMS OF

ENGAGEMENT. The shares represented by the Proxy Instrument

will be voted or withheld from voting in accordance with the

instructions of the shareholder on any ballot that may be called

for and, if the shareholder specifies a choice with respect to any

matter to be acted upon, the shares will be voted accordingly. The

enclosed Proxy Instrument confers discretionary authority on the

persons named therein with respect to amendments or variations to

matters identified in the Notice or other matters which may

properly come before the Meeting. As of the date of this proxy

statement, management of the Corporation knows of no such

amendments, variations, or other matters to come before the

Meeting. However, if other matters properly come before the

Meeting, it is the intention of the persons named in the enclosed

Proxy Instrument to vote such proxy according to their best

judgment.

Will shares I hold in my brokerage account be voted if I do not

provide timely voting instructions?

If your

shares are held through a brokerage firm, they will be voted as you

instruct on the voting instruction card provided by your broker. If

you sign and return your card without giving specific instructions,

your shares will be voted in accordance with the recommendations of

our Board.

If you do not return your voting instruction card on a timely

basis, your broker will be prohibited from voting your shares

without your instructions on the election of directors and on any

other proposal. These “broker non-votes” will

be counted only for the purpose of determining whether a quorum is

present at the Meeting and not as votes cast. Such

broker non-votes will have no effect on the outcome of

the matter.

Will shares that I own as a shareholder of record be voted if I do

not timely return my proxy card?

Shares

that you own as a shareholder of record will be voted as you

instruct on your proxy card. If you sign and return your proxy card

without giving specific instructions, they will be voted in

accordance with the procedure set out above under the heading

“How will my shares be

voted?”

If you

do not timely return your proxy card, your shares will not be voted

unless you or your proxy holder attends the Meeting and any

adjournment(s) or postponement(s) thereof and votes during the

Meeting as described above under the heading “How can I vote at the

Meeting?”

When is the deadline to vote by proxy?

If you

hold shares as the shareholder of record, your vote by proxy must

be received no later than 8:30 a.m. (Eastern Time) on September 17,

2021, or at least 48 hours prior to any adjournment(s) of the

Meeting or must be deposited at the Meeting with the chair of the

Meeting before the commencement of the Meeting or any

adjournment(s) thereof.

If you

hold shares as a Beneficial Owner, please follow the voting

instructions provided by Broadridge or your

Intermediary.

May I change or revoke my vote?

Every proxy may be revoked by an instrument in writing that is

received (1) at the registered office of the Company at any time up

to and including 5:00 p.m. (Eastern time) on the last business day before the day set for the

holding of the Meeting or any adjourned or postponed meeting at

which the proxy is to be used or (2) at the Meeting or any

adjourned or postponed meeting, by the chair of the Meeting or

adjourned or postponed meeting, before any vote in respect of which

the proxy has been given has been taken. If the shareholder for

whom the proxy holder is appointed is an individual, the instrument

must be signed by the shareholder or the shareholder’s legal

personal representative or trustee in bankruptcy. If the

shareholder for whom the proxy holder is appointed is a

corporation, the instrument must be signed by the corporation or by

a representative appointed for the corporation.

Shareholder Proposals and Director

Nominations

What is the deadline to submit shareholder proposals to be included

in the proxy materials for next year’s annual

meeting?

The

Corporation is subject to the rules of both the SEC under the

Securities Exchange Act of 1934, as amended (the

“Exchange Act”),

and provisions of the Business Corporations Act (British Columbia)

(“BCBCA”) with

respect to shareholder proposals to be included in the

Corporation’s proxy materials. As clearly indicated under the

BCBCA and SEC rules under the Exchange Act, simply submitting a

shareholder proposal does not guarantee its inclusion in the proxy

materials.

Shareholder

proposals submitted pursuant to SEC rules under the Exchange Act

for inclusion in the Corporation’s proxy materials for next

year’s annual meeting must be received no later than 120 days

before the date of the Corporation’s proxy statement released

to shareholders in connection with the last annual general meeting

(in this case, April 29, 2022),

and must be submitted to Mr. Steve

Neil via e-mail at steve@lowellfarms.com.

Such proposals must also comply with all applicable provisions of

Rule 14a-8 under the Exchange Act.

The

BCBCA also sets out the requirements for a valid proposal and

provides for the rights and obligations of the Corporation and the

submitter upon a valid proposal being made. Proposals submitted

under the applicable provisions of the BCBCA that a shareholder

intends to present at next year’s annual meeting and wishes

to be considered for inclusion in the Corporation’s proxy

statement and form of proxy relating to next year’s annual

meeting must be received at least three (3) months before the

anniversary of the Corporation’s last annual general meeting

(in this case, June 22, 2022). Such proposals must also comply with

all applicable provisions of the BCBCA and the regulations

thereunder.

Proposals

that are not timely submitted or are submitted to the incorrect

address or other than to the attention of our corporate secretary

may, at our discretion, be excluded from our proxy

materials.

See

below under the heading “How

may I nominate director candidates or present other business for

consideration at a meeting?” for a description of the

procedures through which shareholders may nominate director

candidates for consideration.

How may I nominate director candidates for consideration at a

meeting?

Shareholders

who wish to submit director nominees for consideration must give

written notice of their intention to do so to our corporate

secretary at the address set forth below under the heading

“How do I obtain additional

copies of this proxy statement or voting materials?”

Any such notice also must be in the form and include the

information required by our Articles (“Articles”) (which may be obtained

as provided below under the heading “How may I obtain financial and other

information about Lowell Farms Inc.?”). In addition,

shareholders must comply with the deadlines for submission and

other requirements described below. See “Advance Notice Provision” under

“Proposal 1—Election

of Directors” in this proxy statement.

How may I recommend candidates to serve as directors?

Shareholders

may recommend director candidates for consideration by the Board by

writing to our corporate secretary at the address set forth below

under the heading “How do I

obtain additional copies of this proxy statement or voting

materials?” in accordance with the notice provisions

described above under the heading “How may I nominate director candidates or

present other business for consideration at a

meeting?” To be in proper written form, such notice

must set forth the nominee’s name, age, business, and

residential address, and principal occupation or employment for the

past five (5) years, their direct or indirect beneficial

ownership in, or control or direction over, any class of securities

of the Corporation, including the number or principal amount and

such other information on the nominee and the nominating

shareholder as set forth in the Articles, which may be obtained in

accordance with the instructions below under the heading

“How may I obtain financial

and other information about Lowell Farms

Inc.?”

Description of the Corporation’s Voting

Securities

As of

the Record Date, there were 154 shareholders of record holding

78,992,636 Subordinate Voting

Shares and one shareholder of record holding 202,590 Super Voting Shares.

The

Subordinate Voting Shares are “restricted securities”

within the meaning of such term under applicable Canadian

securities laws. Under Canadian securities laws, a

“restricted security” includes an equity security of a

reporting issuer if there is another class of securities of the

reporting issuer that carries a greater number of votes per

security relative to the equity security.

Holders

of Subordinate Voting Shares are entitled to notice of and to

attend any meeting of the shareholders of the Corporation, except a

meeting of which only holders of another particular class of shares

of the Corporation have the right to vote. At each such meeting,

holders of Subordinate Voting Shares are entitled to one vote in

respect of each Subordinate Voting Share held.

Holders

of Super Voting Shares are entitled to notice of and to attend any

meeting of the shareholders of the Corporation, except a meeting of

which only holders of another particular class of shares of the

Corporation have the right to vote. At each meeting of

shareholders, holders of Super Voting Shares are entitled to 1,000

votes per share.

Obtaining Additional Information

How may I obtain financial and other information about Lowell Farms

Inc.?

Financial

and other information is provided in the Corporation’s

audited consolidated financial statements and management’s

discussion and analysis for the fiscal year ended December 31,

2020, which are included in our Annual Report. The Company is

mailing the Annual Report along with this Proxy Statement and the

enclosed Proxy Instrument. In addition, we will furnish

a copy of our Annual Report without charge to any shareholder who

so requests by writing to our corporate secretary at the address

below under the heading in “How do I obtain additional copies of this

proxy statement or voting materials?” The Annual

Report is also available free of charge on our website at

https://ir.lowellfarms.com/sec-filings.

By

writing to us, shareholders also may obtain, without charge, a copy

of the Articles, Code of Ethics and Business Conduct

(“Code of

Conduct”), and Board committee charters.

What if I have questions for the Corporation’s transfer

agent?

If you

are a shareholder of record and have questions concerning share

certificates, ownership transfer, or other matters relating to your

share account, please contact our transfer agent at the following

address:

Odyssey

Trust Company

67 Yonge St., Suite 702

Toronto, Ontario, M5E IJ8

How do I obtain additional copies of this proxy statement or voting

materials?

If you

need additional copies of this proxy statement or voting materials,

please contact us at:

Lowell

Farms Inc.

Attn:

Corporate Secretary

19

Quail Run Circle, Suite B

Salinas,

California 93907

ir@lowellfarms.com

OVERVIEW OF PROPOSALS TO BE VOTED

ON

Proposals

1 and 2 are included in this proxy statement at the direction of

our Board. Our Board unanimously recommends that you vote

“FOR”

the election of the nominees in Proposal 1 and “FOR” the appointment and

remuneration of auditors in Proposal 2.

PROPOSAL 1—ELECTION OF

DIRECTORS

The

Articles provide that the number of directors should not be fewer

than three (3) directors. There are currently seven directors

of the Corporation. At the Meeting, it is proposed to elect seven

(7) directors.

The

Board proposes to nominate at the Meeting each person whose name is

set forth in the table below, each to serve as a director of the

Corporation until the next Meeting at which the election of

directors is considered, or until such person’s successor is

duly elected or appointed, unless such person resigns, is removed

or otherwise ceases to be a director in accordance with the

Articles or the BCBCA. The persons named in the accompanying Proxy

Instrument intend to vote for the election of such persons at the

Meeting, unless otherwise directed. Management does not contemplate

that any of the nominees will be unable to serve as a director of

the Corporation. Please see the discussion of the Voting Agreement

set forth in the Security Ownership of Certain Beneficial Owners

and Management section of this proxy statement relating to the

number of directors and the composition of the Board of

Directors.

The

following table and the notes thereto set out the name of each of

the current directors, each proposed by management to be nominated

for election as a director of the Corporation at the Meeting, their

respective positions, and the period during which they have been a

director of the Corporation.

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Age

|

|

Position(s)

|

|

Location of Residence

|

|

Director Since

|

|

George

Allen (1)

|

|

46

|

|

Chairman

|

|

New

York, U.S.

|

|

April

2020

|

|

Mark

Ainsworth

|

|

47

|

|

Chief

Executive Officer and Director

|

|

California,

U.S.

|

|

April

2019

|

|

Stephanie

Harkness (2)

|

|

78

|

|

Director

|

|

California,

U.S.

|

|

April

2019

|

|

William

Anton (1)(2)

|

|

80

|

|

Director

|

|

Nevada,

U.S.

|

|

April

2019

|

|

Kevin

McGrath (1)

|

|

48

|

|

Director

|

|

Commonwealth

of Puerto Rico, U.S. Territory

|

|

April

2020

|

|

Brian

Shure

|

|

45

|

|

Chief

Financial Officer and Director

|

|

District

of Columbia, U.S.

|

|

April

2020

|

|

Bruce

Gates

|

|

60

|

|

Director

|

|

Montana,

U.S.

|

|

October

2020

|

____________

(1)

Member of the Audit

Committee.

(2)

Member of the

Compensation and Corporate Governance Committee.

Biographical Information

The

biographies of the proposed nominees for the Board are set out

below.

George Allen

George Allen has served as the non-executive Chairman and Director

of the Company since April 2020. Mr. Allen is the Founder of

Geronimo Capital LLC, a cannabis-industry investment firm, and has

been its Managing Member since April 2019. Mr. Allen was the

President of Acreage Holdings, a cannabis multi-state operator,

from August 2017 to April 2019. At the time of his departure from

Acreage Holdings, it was the largest multi-state operator with the

broadest footprint in the United States. Mr. Allen was the Chief

Investment Officer of Cambridge Information Group, a family

investment office, from July 2015 to August 2017. Mr. Allen holds a

Bachelor of Science degree in Mechanical Engineering from Yale

University. From 2011 to 2014, Mr. Allen led an acquisition-driven

restructuring of Blucora (NASDAQ: BCOR) into a leading provider of

wealth management and tax software. Prior to Blucora, Mr. Allen

spent nine years at Warburg Pincus, where he managed investments in

the communication, media, and technology sectors. He also worked at

Goldman Sachs in New York and Hong Kong, where he invested capital

in distressed securities. The Company believes that Mr.

Allen’s extensive public company and executive-level

experience and his expertise in strategy, mergers and acquisitions,

and corporate finance qualify him to serve as our

Chairman.

Mark Ainsworth

Mark Ainsworth serves as Chief Executive Officer of the Corporation

and has also served as a director of the Corporation since April

2019. Mr. Ainsworth previously served as the Company’s Chief

Operating Officer (November 2019 to April 2020) and Executive Vice

President (April 2019 to April 2020) and as Executive Vice

President of Indus Holding Company (inception to April 2019). In

2006, Mr. Ainsworth founded Pastry Smart, an American Humane

Certified and Organic bakery and confectionery manufacturer. He has

been a member of the American Culinary Federation since 2013. The

Company believes that Mr. Ainsworth’s long history as an

entrepreneur and as a co-founder of the Company as well as his

executive-level experience qualify him to serve as a member of our

Board.

Stephanie Harkness

Stephanie Harkness has served as an independent director of the

Company since April 2019. Ms. Harkness is the Managing General

Partner of OPES Holdings, LLC, a venture capital and private equity

firm. From 1980 to 2011, Ms. Harkness was CEO of Pacific Plastics

& Engineering, a leading medical device manufacturer in the San

Francisco Bay area. Ms. Harkness was formerly the Chairperson of

the National Association of Manufacturers, a member of the Board of

Directors for Dignity Health Hospital, and Chair of the Silicon

Valley Capital Club Board of Governors. Ms. Harkness holds a B.S.

degree from California Polytechnic State University. The Company

believes that Ms. Harkness’ extensive experience as a senior

executive and director and her long history of value creation with

companies at both early and later stages of their development

qualify her to serve as a member of our Board.

William Anton

William Anton has served as an independent director of the Company

since April 2019. Mr. Anton has served as Chairman and CEO of Anton

Enterprises, Inc. since 2005 and Managing Partner of Anton Venture

Capital Fund LLC since 2004. Prior to Anton Enterprises, he was

Chairman of Anton Airfood, Inc. from 1989 to 2005, the airport

foodservice company he founded. Mr. Anton is Chairman Emeritus of

the Board of Trustees of the Culinary Institute of America. He also

serves on the Board of Trustees of Media Research Corporation, the

Board of Directors of QSpex Technologies Inc., and is a member of

the Board of Governors of the Thalians Foundation for Mental Health

at Cedars-Sinai. Mr. Anton formerly served on the Board of

Directors of Air Chef Corporation, a leading private aviation

catering firm in North America, the Board of Directors for

Morton’s Restaurant Group, the Board of the British

Restaurant Association, the Board of Trustees of the William F.

Harrah College – University of Nevada in Las Vegas, and the

National Restaurant Association Education Foundation. The Company

believes that Mr. Anton’s extensive experience as a senior

executive and director and his lengthy history of value-creation as

a founder and entrepreneur qualify him to serve as a member of our

Board.

Kevin McGrath

Kevin McGrath has served as an independent director of the Company

since April 2020. Mr. McGrath holds stakes in privately held

medical cannabis companies such as Theraplant LLC and Leafline Labs

LLC, as well as being an early investor and former special advisor

to GrowGeneration. Mr. McGrath is a member of the board of

directors of NextGen Pharma/Bwell Group. Prior to joining the

Company’s board, Mr. McGrath was a founding partner of Merus

Capital Partners, a New York City-based Hedge Fund. Mr. McGrath has

held portfolio manager titles at Millennium Capital Management,

Quad Capital Advisors, and First New York securities. Mr. McGrath

is a graduate of the University of Notre Dame. The Company believes

that Mr. McGrath’s experience as a director, his expertise in

corporate finance, and his deep knowledge of the cannabis industry

qualify him to serve as a member of our Board.

Brian Shure

Brian Shure has served as a director of the Company since April

2020 and was appointed as Chief Financial Officer in November 2020.

Mr. Shure leads Ambrose Capital Partners, an investment management

firm, directing public and private investments where he has served

as President since 2008. Mr. Shure served as Chief Financial

Officer of MedData, a revenue cycle management company in the

healthcare industry, where he oversaw significant organic and

M&A growth. Mr. Shure joined MedData following the

company’s acquisition of Cardon Outreach, where he led

finance and M&A strategy as Chief Financial Officer. The

Company believes that Mr. Shure’s extensive experience as a

financial executive and his expertise in mergers and acquisitions

and corporate finance qualify him to serve as a member of our

Board.

Bruce Gates

Bruce Gates has served as an independent director of the Company

since October 2020. Mr. Gates founded and since November 2017

has served as the President of Three Oaks Strategies, LLC, a

multi-disciplined consultancy firm, and of Three Oaks Asset

Management, LLC, a family office and venture capital firm. Mr.

Gates was the Senior Vice President, External Affairs for Altria

Group, Inc. from 2008 until October 2017. Mr.Gates served as a

director of Cronos Group Inc. (Nasdaq: CRON) and as the Chair of

its compensation committee from March 2019 to March 2020.

Mr. Gates received his B.A. from the University of Georgia. The

Company believes that Mr. Gates’ extensive experience as a

senior executive and director qualifies him to serve as a member of

our Board.

The persons named in the accompanying Proxy Instrument (if named

and absent contrary directions) intend to vote the shares

represented thereby FOR

the election of each of the

aforementioned named nominees unless otherwise instructed on a

properly executed and validly deposited proxy. Management of

the Corporation does not contemplate that any nominees named above

will be unable to serve as a director but, if that should occur for

any reason prior to the Meeting, the persons named in the enclosed

form of proxy reserve the right to vote for another nominee in

their discretion.

Replacement or Removal of Directors

To the

extent that directors are elected or appointed to fill casual

vacancies or vacancies arising from the removal of directors, in

both instances whether by shareholders or directors, the directors

shall hold office until the remainder of the unexpired portion of

the term of the departed director that was replaced.

Advance Notice Provision

Our

Articles include an advance notice provision for the nomination for

election of directors (the “Advance Notice Provision”). The

Advance Notice Provision provides that any shareholder seeking to

nominate a candidate for election as a director (a

“Nominating

Shareholder”) at any annual meeting of the

shareholders, or at any special meeting of shareholders if one of

the purposes for which the special meeting was called was the

election of directors, must give timely notice in proper written

form.

In order for a nomination made by a Nominating Shareholder to be

timely notice (a “Timely

Notice”), the Nominating

Shareholder’s notice must be received by the corporate

secretary of the Company at the principal executive offices or

registered office of the Company: (a) in the case of an annual

meeting of shareholders (including an annual and special meeting),

no later than the 60th day before the date of the meeting;

provided, however, if the first public announcement made by the

Company of the date of the meeting (each such date being the

“Notice Date”) is less than 50 days before the meeting

date, notice by the Nominating Shareholder may be given not later

than the close of business on the 20th day following the Notice

Date; and (b) in the case of a special meeting (which is not also

an annual meeting) of shareholders called for any purpose which

includes the election of directors to the Board, not later than the

close of business on the 15th day following the Notice

Date.

To be in proper written form, a Nominating Shareholder’s

notice to the corporate secretary must comply with all applicable

provisions of the Articles and disclose or include, as

applicable:

(a)

as to each person whom the Nominating Shareholder

proposes to nominate for election as a director (a

“Proposed

Nominee”):

(i)

the

name, age, business, and residential address of the Proposed

Nominee;

(ii)

the

principal occupation/business or employment of the Proposed

Nominee, both presently and for the past five years;

(iii)

the

number of securities of each class of securities of the Company

beneficially owned, or controlled or directed, directly or

indirectly, by the Proposed Nominee, as of the record date for the

meeting of shareholders (if such date shall then have been made

publicly available and shall have occurred) and as of the date of

such notice;

(iv)

full

particulars of any relationships, agreements, arrangements or

understandings (including financial, compensation or indemnity

related) between the Proposed Nominee and the Nominating

Shareholder, or any affiliates or associates of, or any person or

entity acting jointly or in concert with, the Proposed Nominee or

the Nominating Shareholder;

(v)

any

other information that would be required to be disclosed in a

dissident proxy circular or other filings required to be made in

connection with the solicitation of proxies for election of

directors pursuant to the BCBCA or applicable securities law;

and

(vi)

written

consent of each Proposed Nominee to being named as a nominee and

certifying that such Proposed Nominee is not disqualified from

acting as a director under the provisions of subsection 124(2) of

the BCBCA; and

(b)

as

to each Nominating Shareholder giving the notice, and each

Beneficial Owner, if any, on whose behalf the nomination is

made:

(i)

their

name, business, and residential address;

(ii)

the

number of securities of the Company or any of its subsidiaries

beneficially owned, controlled, or directed (directly or

indirectly) by the Nominating Shareholder or any other person with

whom the Nominating Shareholder is acting jointly or in concert

with respect to the Company or any of its securities, as of the

record date for the meeting of shareholders (if such date shall

then have been made publicly available and shall have occurred) and

as of the date of such notice;

(iii)

their

interests in, or rights or obligations associated with, any

agreement, arrangement, or understanding, the purpose or effect of

which is to alter, directly or indirectly, the person’s

economic interest in a security of the Company or the

person’s economic exposure to the Company;

(iv)

any

relationships, agreements, or arrangements, including financial,

compensation, and indemnity related relationships, agreements, or

arrangements, between the Nominating Shareholder or any affiliates

or associates of, or any person or entity acting jointly or in

concert with, the Nominating Shareholder and any Proposed

Nominee;

(v)

full

particulars of any proxy, contract, relationship arrangement,

agreement, or understanding pursuant to which such person, or any

of its affiliates or associates, or any person acting jointly or in

concert with such person, has any interests, rights, or obligations

relating to the voting of any securities of the Company or the

nomination of directors to the Board;

(vi)

a

representation that the Nominating Shareholder is a holder of

record of securities of the Company, or a Beneficial Owner,

entitled to vote at such meeting, and intends to appear in person

or by proxy at the meeting to propose such nomination;

(vii)

a

representation as to whether such person intends to deliver a proxy

circular or form of proxy to any shareholder of the Company in

connection with such nomination or otherwise solicit proxies or

votes from shareholders of the Company in support of such

nomination; and

(viii)

any

other information relating to such person that would be required to

be included in a dissident proxy circular or other filings required

to be made in connection with solicitations of proxies for election

of directors pursuant to the BCBCA or as required by

applicable securities law.

The

chair of the meeting shall have the power to determine whether a

nomination was made in accordance with the notice procedures set

forth in the Articles and, if any proposed nomination is not in

compliance with such provisions, must declare that such defective

nomination will be disregarded.

Notwithstanding

the foregoing, the Board may, in its sole discretion, waive any

requirement in the Advance Notice Provision.

As of

the date of this proxy statement, the Corporation has not received

any nominations under the Advance Notice Provision.

Corporate Cease Trade Orders, Bankruptcies, Penalties, or

Sanctions

To the

Corporation’s knowledge, no proposed director is, as at the

date of this proxy statement, or has been, within the ten

(10) years prior to the date of this proxy statement, a

director, chief executive officer, or chief financial officer of

any company (including the Corporation) that: (i) while that

person was acting in that capacity was the subject of a cease trade

order or similar order, or an order that denied the relevant

company access to any exemption under securities legislation (an

“Order”) for a

period of more than thirty (30) consecutive days; or

(ii) after that person ceased acting in that capacity, was

subject to an Order, which resulted from an event that occurred

while that person was acting in the capacity of director, chief

executive officer, or chief financial officer.

To the

Corporation’s knowledge, no proposed director is, as at the

date of this proxy statement, or has been, within the ten

(10) years prior to the date of this proxy statement, a

director or executive officer of any company (including the

Corporation) that while that person was acting in that capacity, or

within a year of that person ceasing to act in that capacity,

became bankrupt, made a proposal under any legislation relating to

bankruptcy or insolvency or was subject to or instituted any

proceedings, arrangement, or compromise with creditors or had a

receiver, receiver-manager, or trustee appointed to hold its

assets.

To the

Corporation’s knowledge, no proposed director has, during the

ten (10) years prior to the date of this proxy statement,

become bankrupt, made a proposal under any legislation relating to

bankruptcy or insolvency, or became subject to or instituted any

proceedings, arrangement, or compromise with creditors, or had a

receiver, receiver-manager, or trustee appointed to hold assets of

the proposed director.

To the Corporation’s knowledge, no proposed director has been

subject to any penalties or sanctions imposed by a court relating

to securities legislation or by a securities regulatory authority

or has entered into a settlement agreement with a securities

regulatory authority, or been subject to any other penalties or

sanctions imposed by a court or regulatory body that would likely

be considered important to a reasonable securityholder in deciding

whether to vote for the proposed director.

Indebtedness of Directors, Executive Officers, and

Employees

None of

(i) the individuals who are, or at any time since the beginning of

the last fiscal year of the Corporation were, a director or

executive officer of the Corporation, (ii) the proposed nominees

for election as a director of the Corporation, or (iii) any

associates of the foregoing persons, is or at any time since

the beginning of the most recently completed fiscal year of the

Corporation has been, indebted to the Corporation or any of its

subsidiaries or is a person whose indebtedness to another entity

is, or at any time since the beginning of the most recently

completed fiscal year of the Corporation has been, the subject of a

guarantee, support agreement, letter of credit, or other similar

arrangement or understanding provided by the Corporation or any of

its subsidiaries.

Requirements under the Business Corporations Act (British

Columbia)

Pursuant

to the BCBCA, directors and officers are required to act honestly

and in good faith with a view to the best interests of the

Corporation. Under the BCBCA, subject to certain limited

exceptions, a director who holds a disclosable interest in a

material contract or transaction into which we have entered or

propose to enter shall not vote on any directors’ resolution

to approve the contract or transaction. A director or executive

officer has a disclosable interest under the BCBCA in a material

contract or transaction if the director or executive

officer:

●

has a material

interest in the contract or transaction;

●

is a director or

executive officer of a party who has a material interest in the

contract or transaction; or

●

has a material

interest in a party who has a material interest in the contract or

transaction.

Generally,

as a matter of practice, directors or officers who have disclosed a

material interest in any contract or transaction that the Board is

considering will not take part in any Board discussion respecting

that contract or transaction. If such directors were to participate

in the discussions, they would abstain from voting in accordance

with the BCBCA on any matters relating to matters in which they

have disclosed a disclosable interest under the BCBCA.

Interests of Certain Persons in Matters to be Acted

Upon

Other

than the election of directors or the appointment of auditors,

management of the Corporation is not aware of any material

interest, direct or indirect, by way of beneficial ownership of

securities or otherwise, of any person who has been a director or

executive officer of the Corporation at any time since the

beginning of the Corporation’s last fiscal year or who is

proposed to be a director of the Corporation or of any associate or

affiliate of any such persons, in any matter to be acted upon at

the Meeting.

Interests of Management of the Corporation and Others in Material

Transactions

Other

than as described elsewhere in this proxy statement, there are no

material interests, direct or indirect, of any of our directors or

executive officers, any shareholder that beneficially owns, or

controls or directs, directly or indirectly, more than 10% of the

voting rights attached to all outstanding voting securities of the

Corporation, any director or executive officer of any such

shareholder or any associate or affiliate of any of the foregoing

persons, in any transaction since the commencement of the

Corporation’s most recently completed fiscal year or in any

proposed transaction which in either such case has materially

affected or would materially affect the Corporation or any of its

subsidiaries on a consolidated basis.

OUR BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR”

THE ELECTION OF THE NOMINEES IN PROPOSAL 1.

PROPOSAL 2—APPOINTMENT AND REMUNERATION

OF AUDITORS

The

members of our Audit Committee and our Board believe the

appointment of GreenGrowth CPAs as our independent registered

public accounting firm is in the best interests of the Corporation

and our shareholders. GreenGrowth CPAs has been the independent

registered public accounting firm of the Corporation since April

29, 2019. Representatives of GreenGrowth CPAs are expected to be

present at the Meeting, have an opportunity to make a statement if

they desire to do so, and are expected to be available to respond

to appropriate questions.

Principal Independent Accountant Fees and Services

Aggregate

fees billed by GreenGrowth CPAs for the years ended

December 31, 2020, and December 31, 2019, are detailed in

the table below.

|

|

|

|

|

Audit Fees(1)

|

126,150

|

89,500

|

|

Audit-Related Fees(2)

|

55,150

|

15,000

|

|

Tax Fees(3)

|

—

|

—

|

|

All Other Fees(4)

|

39,200

|

39,200

|

|

Total

Fees Paid

|

220,500

|

143,700

|

(1)

Fees

for audit service on an accrual basis.

(2)

Fees

not included in audit fees that are billed by the independent

registered public accounting firm for assurance and related

services that are reasonably related to the performance of the

audit or review of the financial statements.

(3)

Fees

for professional services rendered for tax compliance, tax advice

and tax planning.

(4)

All

fees billed by the independent registered public accounting firm

for products and services not included in the foregoing categories,

which consisted of the audit of the historical financial statements

of an acquisition target for 2019 and 2020.

Pre-Approval of Non-Audit Services

The

Audit Committee will pre-approve the appointment of the independent

auditor for any non-audit service to be provided to the

Corporation. Before the appointment of the independent auditor for

any non-audit service, the Audit Committee will consider the

compatibility of the service with the independent auditor’s

independence. The Audit Committee may pre-approve the appointment

of the independent auditor for any non-audit services by adopting

specific policies and procedures, from time to time, for the

engagement of the independent auditor for non-audit services. Such

policies and procedures will be detailed as to the particular

service, and the Audit Committee must be informed of each service,

and the procedures may not include delegation of the Audit

Committee’s responsibilities to management. In addition, the

Audit Committee may delegate to one or more members the authority

to pre-approve the appointment of the independent auditor for any

non-audit service to the extent permitted by applicable law

provided that any pre-approvals granted pursuant to such delegation

shall be reported to the Audit Committee at its next scheduled

meeting.

Audit Committee Report

The material in this report is not “soliciting

material,” is not deemed “filed” with the SEC,

and is not to be incorporated by reference into any filing by

Lowell Farms Inc. under the Securities Act of 1933, as amended, or

the Exchange Act.

The

primary purpose of the Audit Committee is to assist the Board in

fulfilling its responsibilities for oversight of financial, audit

and accounting matters. In addition, the Audit Committee reviews

the financial reports and other financial information provided by

the Corporation to regulatory authorities and its shareholders and

reviews the Corporation’s system of internal controls

regarding finance and accounting, including auditing, accounting

and financial reporting processes.

The Audit Committee has reviewed and discussed the audited

financial statements of the Company for the fiscal year ended

December 31, 2020 with management and has discussed with

GreenGrowth CPAs, the Corporation’s independent registered

public accounting firm for the fiscal year ended December 31, 2020,

those matters required to be discussed by applicable requirements

of the Public Company Accounting Oversight Board (the

“PCAOB”) and the SEC. In addition, the Audit

Committee discussed with GreenGrowth CPAs its independence and

received from GreenGrowth CPAs the written disclosures and the

letter required by applicable requirements of the PCAOB. Finally,

the Audit Committee discussed with GreenGrowth CPAs, with and

without management present, the scope and results of GreenGrowth

CPAs’ audit of such financial statements.

Based

on these reviews and discussions, the Audit Committee recommended

to the Board that such audited financial statements be included in

the Corporation’s Annual Report for the year ended December

31, 2020.

Audit Committee of the Board

William

Anton (Chair)

George

Allen

Kevin

McGrath

OUR BOARD

UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR”

THE APPOINTMENT AND REMUNERATION OF OUR AUDITORS IN PROPOSAL

2.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The tables below sets forth information with respect to the

beneficial ownership of our Super Voting Shares and Subordinate

Voting Shares as of the Record Date by:

●

each person or

entity known by us to own beneficially more than 5% of our

outstanding Subordinate Voting Shares;

●

each of our

directors and executive officers individually; and

●

all of our

executive officers and directors as a group.

The Super Voting Shares carry 1,000 votes per share. The

Subordinate Voting Shares carry 1 vote per share. As of the Record

Date, the Subordinate Voting Shares represented approximately 28.1%

of the voting power of our outstanding voting securities and

approximately 57.4% of the voting power of our voting securities on

a fully diluted basis, and the Super Voting Shares represented

approximately 71.9% of the

voting power of our outstanding voting securities and approximately

42.6% of the voting power of

our voting securities on a fully diluted basis. Fully diluted

calculations take into account Subordinate Voing Shares issuable

upon the conversion of outstanding debentures, the redemption of

Class B Common Shares of our subsidiary, Indus Holding Company, and

the exercise of outstanding warrants and options and Subordinate

Voting Shares subject to unvested restricted stock

units.

The Super Voting Shares are held by Robert Weakley. Mr. Weakley

served as Chairman and Chief Executive Officer of the Company from

the date of the reverse takeover transaction with Indus Holding

Company (the “RTO”) until April 2020 and thereafter as

a member of our board of directors until October 2020. Mr. Weakley

has entered into an agreement with the Company to vote the Super

Voting Shares in accordance with the voting agreement described

below (the “Voting Agreement”) and otherwise as

directed by our board of directors.

In connection with the initial closing in April 2020 of the

Corporation’s private placement of convertible debentures and

warrants (the “Convertible Debenture

Offering”), the Company

and Mr. Weakley entered into the Voting Agreement with the

investors in the Convertible Debenture Offering. Pursuant to the

Voting Agreement, Mr. Weakley and such investors have agreed to

maintain the size of our board of directors at seven directors and

to vote all of their voting securities (including the Super Voting

Shares) to elect three persons (currently George Allen, Brian

Shure, and Kevin McGrath) designated by a majority in interest of

the debenture holders (“Investor

Directors”), three

persons (currently Mark Ainsworth, William Anton, and Stephanie

Harkness) designated by a majority of the incumbent directors or

their successors or, in the event no such director is then serving,

Mr. Weakley (“Indus

Directors”) and one

person designated by mutual agreement of a majority of the Investor

Directors and a majority of the Indus Directors (currently Bruce

Gates). In addition, the parties to the Voting Agreement agreed to

take such actions as are within their control to maintain audit,

compensation, and corporate governance committees consisting of an

equal number of non-employee Investor Directors and Indus

Directors.

Mr. Weakley is also party to an investment agreement with the

Company pursuant to which the Super Voting Shares may be

transferred only with the Company’s consent. The Company has

agreed to grant its consent to a transfer by Mr. Weakley to certain

family members, trusts for their benefit, and entities controlled

by Mr. Weakley or such family members, in each case subject to the

entry by the transferee into an accession agreement with the

Company providing for the same restrictions on transfer and