LOAN AGREEMENT

by and between

VIRIDESCENT REALTY TRUST, INC.

(“Lender”)

and

LOWELL SR LLC,

(“Borrower”)

dated as of June 29, 2021

|

TABLE OF CONTENTS

|

|

|

|

Page

|

|

|

|

|

|

Article

I DEFINITIONS, ACCOUNTING PRINCIPLES, UCC TERMS

|

|

1.1

|

Definitions

|

1

|

|

1.2

|

Singular and Plural Forms

|

10

|

|

1.3

|

UCC Definitions

|

10

|

|

1.4

|

Accounting Terms

|

10

|

|

1.5

|

Amendments, Etc

|

10

|

|

1.6

|

Laws, Etc

|

11

|

|

Article

II TERMS OF THE LOAN

|

|

2.1

|

The Loan

|

11

|

|

2.2

|

Security for the Loan

|

13

|

|

2.3

|

Origination Fee; Transaction Costs

|

14

|

|

2.4

|

Conditions Precedent to Closing

|

14

|

|

Article

III BORROWER’S REPRESENTATIONS AND WARRANTIES

|

|

3.1

|

Existence, Power and Qualification

|

17

|

|

3.2

|

Power and Authority

|

17

|

|

3.3

|

Due Execution and Enforcement

|

18

|

|

3.4

|

Single Purpose Entity

|

18

|

|

3.5

|

Pending Matters

|

18

|

|

3.6

|

Financial Statements Accurate

|

18

|

|

3.7

|

Compliance with Facility Laws

|

18

|

|

3.8

|

Governmental Proceedings and Notices

|

19

|

|

3.9

|

Pledges of Accounts

|

19

|

|

3.1

|

Payment of Taxes and Property Impositions

|

19

|

|

3.11

|

Title to Collateral

|

19

|

|

3.12

|

Priority of Mortgage

|

19

|

|

3.13

|

Location of Chief Executive Offices

|

20

|

|

3.14

|

Disclosure

|

20

|

|

3.15

|

Trade Names

|

20

|

|

3.16

|

ERISA

|

20

|

|

3.17

|

Ownership

|

20

|

|

3.18

|

Intentionally Omitted

|

20

|

|

3.19

|

Bankruptcy

|

20

|

|

3.2

|

Lease Agreement

|

20

|

|

3.21

|

Other Indebtedness

|

20

|

|

3.22

|

Other Obligations

|

20

|

|

3.23

|

Fraudulent Conveyances

|

21

|

|

3.24

|

Fixtures, Furniture and Equipment

|

21

|

|

3.25

|

Sole Purpose

|

21

|

|

3.26

|

Use of Loan Proceeds

|

21

|

|

3.27

|

Intentionally Omitted

|

21

|

|

3.28

|

Other Proceedings

|

21

|

|

3.29

|

Access

|

21

|

|

3.3

|

Encroachments

|

22

|

|

Article

IV AFFIRMATIVE COVENANTS OF BORROWER

|

|

4.1

|

Payment of Loan/Performance of Loan Obligations

|

22

|

|

4.2

|

Maintenance of Existence

|

22

|

|

4.3

|

Maintenance of Single Purpose

|

22

|

|

4.4

|

Accrual and Payment of Taxes

|

22

|

|

4.5

|

Insurance

|

22

|

|

4.6

|

Financial and Other Information

|

28

|

|

4.7

|

Intentionally Omitted

|

29

|

|

4.8

|

Books and Records

|

30

|

|

4.9

|

Payment of Indebtedness

|

30

|

|

4.1

|

Conduct of Business

|

30

|

|

4.11

|

Intentionally Omitted

|

30

|

|

4.12

|

Financial Covenants

|

30

|

|

4.13

|

Fixtures, Furniture and Equipment

|

30

|

|

4.14

|

Intentionally Omitted

|

30

|

|

4.15

|

Updated Appraisals

|

31

|

|

4.16

|

Comply with Covenants and Laws

|

31

|

|

4.17

|

Taxes and Other Charges

|

31

|

|

4.18

|

Intentionally Omitted

|

31

|

|

4.19

|

Certificate

|

31

|

|

4.2

|

Notice of Fees or Penalties

|

31

|

|

4.21

|

Lease Agreement

|

31

|

|

4.22

|

Intentionally Omitted

|

32

|

|

4.23

|

Loan Closing Certification

|

32

|

|

4.24

|

Intentionally Omitted

|

32

|

|

4.25

|

Management

|

32

|

|

4.26

|

Mortgage Tax

|

32

|

|

Article

V NEGATIVE COVENANTS OF BORROWER

|

|

5.1

|

Assignment of Licenses and Permits

|

32

|

|

5.2

|

No Liens; Exceptions

|

33

|

|

5.3

|

Merger, Consolidation, Etc

|

33

|

|

5.4

|

Maintain Single-Purpose Entity Status

|

34

|

|

5.5

|

Change of Business

|

35

|

|

5.6

|

Changes in Accounting

|

35

|

|

5.7

|

ERISA Funding and Termination

|

35

|

|

5.8

|

Transactions with Affiliates

|

35

|

|

5.9

|

Transfer of Property or any Ownership Interests

|

35

|

|

5.1

|

Change of Use

|

35

|

|

5.11

|

Place of Business

|

35

|

|

5.12

|

Acquisitions

|

35

|

|

5.13

|

Dividends, Distributions and Redemptions

|

36

|

|

5.14

|

Conduct of Business

|

36

|

|

5.15

|

Regulated Assets

|

36

|

|

Article

VI ENVIRONMENTAL HAZARDS

|

|

6.1

|

Prohibited Activities and Conditions

|

37

|

|

6.2

|

Intentionally Omitted

|

37

|

|

6.3

|

Preventive Action

|

37

|

|

6.4

|

Intentionally Omitted

|

37

|

|

6.5

|

Borrower’s Environmental Representations and

Warranties

|

37

|

|

6.6

|

Notice of Certain Events

|

38

|

|

6.7

|

Costs of Inspection

|

38

|

|

6.8

|

Remedial Work

|

38

|

|

6.9

|

Cooperation with Governmental Authorities

|

39

|

|

6.1

|

Indemnity

|

39

|

|

Article

VII PAYMENT RESERVES

|

|

7.1

|

Establishment of Payment Reserves

|

41

|

|

7.2

|

Required Repairs

|

41

|

|

7.3

|

Debt Reserve

|

41

|

|

7.4

|

Security Interest in Payment Reserves

|

41

|

|

Article

VIII EVENTS OF DEFAULT AND REMEDIES

|

|

8.1

|

Events of Default

|

43

|

|

8.2

|

Remedies

|

45

|

|

8.3

|

Costs of Collection and Enforcement

|

46

|

|

8.4

|

Offsets

|

47

|

|

Article

IX MISCELLANEOUS

|

|

9.1

|

Waiver

|

47

|

|

9.2

|

Costs and Expenses

|

48

|

|

9.3

|

Performance of Lender

|

48

|

|

9.4

|

Indemnification

|

49

|

|

9.5

|

Headings

|

50

|

|

9.6

|

Survival of Covenants

|

50

|

|

9.7

|

Notices, etc

|

50

|

|

9.8

|

Benefits and Information Sharing

|

51

|

|

9.9

|

Supersedes Prior Agreements; Counterparts

|

51

|

|

9.1

|

Loan Agreement Governs

|

51

|

|

9.11

|

CONTROLLING LAW

|

52

|

|

9.12

|

WAIVER OF JURY TRIAL

|

52

|

|

9.13

|

Intentionally Omitted

|

52

|

|

9.14

|

Patriot Act Compliance

|

52

|

|

9.15

|

Secondary Market Transactions

|

53

|

|

(a)

|

Right to Sell

|

53

|

|

(b)

|

Right to Participate

|

54

|

|

9.16

|

Construction

|

54

|

|

9.17

|

No Partnership

|

54

|

|

9.18

|

Financing Statements

|

54

|

|

9.19

|

Press Releases

|

55

|

|

9.2

|

Change in Law

|

55

|

|

9.21

|

Applicability of Cannabis Laws

|

55

|

LIST OF EXHIBITS

|

Exhibit

A

|

Legal

Description

|

|

Exhibit

B

|

Required

Repairs

|

|

Exhibit

C

|

Amortization

Schedule

|

|

Exhibit

D

|

Permitted

Encumbrances

|

|

Exhibit

E

|

Existing

Insurance Coverages

|

LIST OF SCHEDULES

|

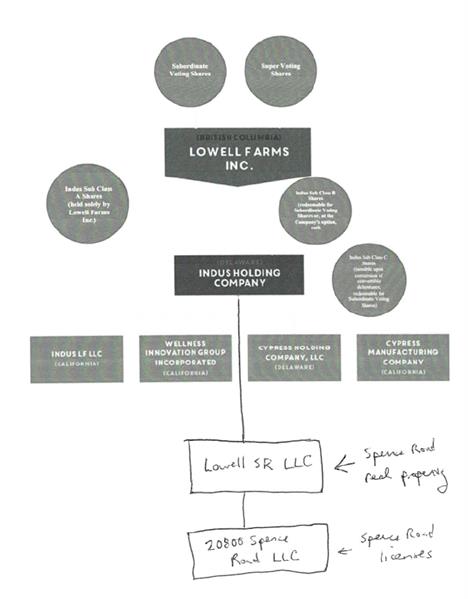

Schedule

3.17

|

Organizational

Chart of Each Loan Party

|

LOAN AGREEMENT

THIS LOAN AGREEMENT (this

“Agreement”) is made as of

June 29, 2021, by and between LOWELL SR LLC, a California limited

liability company, having its principal office at 20 Quail Run

Circle, Salinas, California 93907 (together with its successors and

assigns, the “Borrower”), and

VIRIDESCENT REALTY TRUST,

INC., a Maryland real estate investment trust, having an

address at c/o Viridescent Capital Partners, 10242 Greenhouse Road,

Building 1201, Cypress, Texas 77433 (“Lender”).

RECITALS

Borrower has

requested that the Lender make a loan to Borrower in the aggregate

principal sum of up to

Nine Million Three Hundred Sixty and No/100 Dollars ($9,360,000.00)

(the “Loan”) for the purpose of

purchasing the Property (hereinafter defined).

Lender

is willing to make the Loan, and Borrower is willing to borrow the

Loan, on the terms and conditions set forth in this Agreement and

the other Loan Documents.

AGREEMENTS

NOW,

THEREFORE, Borrower and Lender hereby agree as

follows:

ARTICLE

I

DEFINITIONS,

ACCOUNTING PRINCIPLES, UCC TERMS.

1.1 Definitions. As used in this

Agreement, the following terms shall have the following meanings

unless the context hereof shall otherwise indicate:

“Accounts” any rights of

Borrower arising from the ownership of the Facility, including,

without limitation: (a) all accounts arising from the Lease and/or

ownership of the Facility; and (b) all moneys and accounts held by

Lender pursuant to this Agreement. Accounts shall include the

proceeds thereof (whether cash or non-cash, moveable or immoveable,

tangible or intangible) received from the sale, exchange, transfer,

collection or other disposition or substitution

thereof.

“Affiliate” means, with

respect to any Person: (a) each Person that controls, is controlled

by or is under common control with such Person; and (b) each Person

that, directly or indirectly, owns or controls, whether

beneficially or as a trustee, guardian or other fiduciary, twenty

percent (20%) or more of the Stock of such Person.

“Agreement” is defined in

this preface to this Agreement.

“Amortization Commencement

Date” means the first day of the 13th full calendar

month after the Closing Date.

“Assignment of Rents and

Leases” means that certain Assignment of Rents and

Leases executed by Borrower and Lender of even date herewith, as

the same may be amended, restated, replaced, subleased or modified

from time to time.

“Borrower”

means Lowell SR LLC, a California limited liability company,

and its successors and assigns.

“Borrower’s

knowledge” means

(i) the actual knowledge of Borrower, or (ii) the

knowledge a Borrower would have had if a Borrower had made due

inquiry regarding the fact or other matter in question as a prudent

business person would be expected to make in the management of the

Borrower’s business affairs.

“Business” means the

cannabis drying, trimming, packaging, extraction and processing to

be performed in the Facility in accordance with all Licenses,

Permits and Limited Governmental Requirements.

“Business Day” means any

day on which banks, savings and loan associations, savings banks,

or other financial institutions are generally open for regular

banking business in the State of California.

“Claim” is defined in

Section

6.10(c).

“Closing Date” means the

date on which all or any part of the Loan is disbursed by the

Lender to or for the benefit of Borrower, including to any loan

escrow funding agent.

“Collateral” means,

collectively, all of Borrower’s right, title and interest in

and to the Property, Improvements, Equipment, Rents, Accounts,

General Intangibles (including the Spence Rd Equity), Instruments,

Money, Deposit Accounts, Permits (to the full extent assignable),

Reimbursement Contracts, Imposition Deposits, Debt Reserve, and all

Proceeds, all whether now owned or hereafter acquired, and

including replacements, additions, accessions, substitutions, and

products thereof and thereto, all other assets of the Borrower,

wherever located, whether now owned or existing or hereafter

acquired or arising, together with all proceeds thereof, and all

other property of Borrower which is or hereafter may become subject

to a Lien in favor of Lender as security for any of the Loan

Obligations; notwithstanding anything to the contrary contained

herein, the “Collateral” shall not, include, (i) any

assets of Borrower over which any mortgage, pledge, hypothecation,

assignment (as security), deposit arrangement, encumbrance, lien

(statutory or other), charge or other security interest may not be

granted due to (x) the operation of any applicable legal

requirements, or (y) any agreement that by its terms would be in

breach if it served as security for a debt; (ii) any marijuana or

marijuana-related product, including any cannabidiol product; and

(iii) all other permits, licenses or agreements issued by or with

any other governmental authority related to the operation of

marijuana businesses which by their terms prohibit the pledging of

interests therein.

“Constituent of Borrower”

is defined in Section 9.14(b).

“Debt” means the

outstanding principal amount set forth in, and evidenced by, this

Agreement and the Note, including the Exit Fee, any prepayment

premium payable pursuant to Section 2.1(c)(iii) together

with all interest accrued and unpaid thereon and all other sums

owing to Lender in respect of the Loan under the Note, this

Agreement, the Security Instrument or any other Loan

Document.

“Debt Reserve” is defined

in Section

7.3(a).

“Debt Service” means, with

respect to any particular period of time, scheduled principal and

interest payments due under the Note.

“Default” means the

occurrence or existence of any event which, but for the giving of

notice or expiration of time or both, would constitute an Event of

Default.

“Default Rate” means a per

annum rate of interest equal to the lesser of (a) five hundred

(500) basis points (i.e., 5.00 percentage points) in excess of

Interest Rate, or (ii) the maximum rate of interest which may be

collected from Borrower under applicable law.

“Disbursement Date” is the

first date on which a Lender disburses any proceeds of the Loan to

or for the account of Borrower or to any loan escrow or funding

agent.

“Environmental Indemnity

Agreement” means that certain Environmental Indemnity

Agreement dated as of the date hereof by and among Borrower,

Operator and Guarantor in favor of Lender, as the same may be

amended, restated, replaced or modified from time to

time.

“Environmental Permit”

means any Permit issued under any Hazardous Materials Law with

respect to any activities or businesses conducted on or in relation

to the Property and/or the Improvements.

“Environmental Reports” is

defined in Section

2.4(c)(v).

“Equipment” means all

machinery, furniture, furnishings, equipment, computer software and

hardware, fixtures (including all heating, air conditioning,

plumbing, lighting, communications and elevator fixtures),

materials, supplies and other articles of personal property and

accessions thereof, renewals and replacements thereof and

substitutions therefor, and other property of every kind and

nature, tangible or intangible, owned by Borrower, or in which

Borrower has or shall have an interest, now or hereafter located

upon the Facility or the Improvements, or appurtenant thereto, and

usable in connection with the present or future operation and

occupancy of the Facility and the Improvements.

“Event of Default” means

any “Event of Default” as defined in Article VIII

hereof.

“Exhibit” means an Exhibit

to this Agreement, unless the context refers to another document,

and each such Exhibit shall be deemed a part of this Agreement to

the same extent as if it were set forth in its entirety wherever

reference is made thereto.

“Exit Fee” mean an amount

equal to one percent (1.0%) of the outstanding principal balance of

the Loan.

“Facility” means the

cannabis drying, trimming, packaging, extraction and processing

facility located on the Property, as it may now or hereafter exist,

together with any other cannabis-related facilities, if any, now or

hereafter operated on the Property.

“Facility License” means

the license(s) issued to the Operator and Spence Rd to operate the

Facility.

“GAAP” means, as in effect

from time to time, generally accepted accounting principles

consistently applied as promulgated by the American Institute of

Certified Public Accountants.

“General Intangibles”

means all intangible personal property of Borrower arising out of

or connected with the Property or the Facility and all renewals and

replacements thereof and substitutions therefor (other than

Accounts, Rents, Instruments, Money and Permits), including,

without limitation, choses in action, contract rights and other

rights to payment of money.

“Governmental Authority”

means any board, commission, carrier, intermediary, department or

body of any municipal, county, state or federal governmental unit,

or any subdivision of any of them, that has or acquires

jurisdiction over the Borrower, Operator, Facility, the Property

and/or the Improvements or the use, operation or improvement of the

Property.

“Guarantee” by any Person

means any obligation, contingent or otherwise, of such Person

directly or indirectly guaranteeing any Indebtedness or other

obligation of any other Person and, without limiting the generality

of the foregoing, any obligation, direct or indirect, contingent or

otherwise, of such Person (a) to purchase or pay (or advance

or supply funds for the purchase or payment of) such Indebtedness

or other obligation (whether arising by virtue of partnership

arrangements, by agreement to keep-well, to purchase assets, goods,

securities or services, to take-or-pay, or to maintain financial

statement conditions or otherwise), or (b) entered into for

the purpose of assuring in any other manner the obligee of such

Indebtedness or other obligation of the payment thereof or to

protect such obligee against loss in respect thereof (in whole or

in part), provided,

however, that the term Guarantee shall not include

endorsements for collection or deposit in the Ordinary Course of

Business. The term “guarantee” used as a verb

has a corresponding meaning.

“Guarantor” means,

individually and collectively, Indus Holding Company, a Delaware

corporation, and any Loan Party that has executed or delivered, or

shall in the future execute or deliver, any Guarantee of any

portion of the Loan Obligations.

“Guaranty Agreement” means

any document evidencing any Guarantee of any portion of the Loan

Obligations executed by a Guarantor.

“Hazardous Materials”

means petroleum and petroleum products and compounds containing

them, including gasoline, diesel fuel and oil; explosives;

flammable materials; radioactive materials; polychlorinated

biphenyls (“PCBs”) and compounds containing them; lead

and lead-based paint; asbestos or asbestos-containing materials in

any form that is or could become friable; underground storage

tanks, whether empty or containing any substance; any substance the

presence of which on the Property is prohibited by any federal,

state or local authority; any substance that requires special

handling; and any other material or substance now or in the future

defined as a “hazardous substance,” “hazardous

material,” “hazardous waste,” “toxic

substance,” “toxic pollutant,”

“contaminant,” or “pollutant” within the

meaning of any Hazardous Materials Law or regulated under any

Hazardous Materials Law.

“Hazardous Materials Laws”

means all federal, state, and local laws (including common law),

ordinances and regulations and standards, rules, policies and other

governmental requirements, administrative rulings and court

judgments and decrees (including any judicial or administrative

interpretations, guidance, directives, policy statements or

opinions) in effect now or in the future and including all

amendments, that relate to the protection or pollution of the

environment or to Hazardous Materials. Hazardous Materials Laws

include, but are not limited to, the Comprehensive Environmental

Response, Compensation and Liability Act, 42 U.S.C. Section 9601,

et seq., the Resource Conservation and Recovery Act, 42 U.S.C.

Section 6901, et seq., the Toxic Substance Control Act, 15 U.S.C.

Section 2601, et seq., the Clean Water Act, 33 U.S.C. Section 1251,

et seq., and the Hazardous Materials Transportation Act, 49 U.S.C.

Section 1801, and their state analogs.

“Impositions” and

“Imposition

Deposits” mean the Impositions and Imposition Deposits

defined in the Security Instrument.

“Improvements” means all

buildings, structures and improvements of every nature whatsoever

now or hereafter situated on the Property, including, but not

limited to, all gas and electric fixtures, radiators, heaters,

engines and machinery, boilers, ranges, elevators and motors,

plumbing and heating fixtures, carpeting and other floor coverings,

water heaters, awnings and storm sashes, and cleaning apparatus

which are or shall be attached to the Property or said buildings,

structures or improvements.

“Indebtedness” means any

(a) obligations for borrowed money, (b) obligations, payment for

which is being deferred by more than thirty (30) days, representing

the deferred purchase price of property other than accounts payable

arising in the ordinary course of the business of Borrower, (c)

obligations, whether or not assumed, secured by Liens or payable

out of the proceeds or production from the Accounts and/or real or

personal property now or hereafter owned or acquired by Borrower or

Operator, and (d) the amount of any other obligation (including

obligations under financing leases) which would be shown as a

liability on a balance sheet prepared in accordance with

GAAP.

“Indemnitees” is defined

in Section

6.10(a).

“Instruments” means all

instruments, chattel paper, documents or other writings obtained

from or in connection with the operation of the Property or the

construction and operation of the Facility (including, without

limitation, all ledger sheets, computer records and printouts, data

bases, programs, books of account, trademarks or trade names,

utility contracts, maintenance and service contracts, and files

relating thereto).

“Interest Rate” means

twelve and one-half percent (12.50%) per annum.

“Late Charge” is defined

in Section

2.1(c)(viii).

“Lease Agreement” means

that certain Lease Agreement made as of the date hereof by and

between the Borrower, as Landlord and the Operator, as Tenant, with

respect to the Facility, as the same may be amended, restated,

replaced, subleased or modified from time to time.

“Leases” means,

individually and collectively, the Lease Agreement, together with

any other oral or written leases, subleases, licenses, concessions,

occupancy agreement and other agreements for the use or occupancy

made or agreed to by, any person or entity and any and all

amendments, extensions, renewals, modifications and replacements

thereof pertaining to all or any part of the Property, or any

possessory interest therein, whether such leases or other

agreements have been heretofore or are hereafter made or agreed

to.

“Lien” means any voluntary

or involuntary mortgage, security deed, deed of trust, lien,

pledge, assignment, security interest, title retention agreement,

financing lease, levy, execution, seizure, judgment, attachment,

garnishment, charge, lien or other encumbrance of any kind,

including those contemplated by or permitted in this Agreement and

the other Loan Documents.

“Limited Governmental

Requirement” means all applicable laws, laws, rules,

and regulations and other legal requirements, excluding, however, any U.S. federal laws,

statutes, codes, ordinances, decrees, rules or regulations which

apply to the cultivation, harvesting, production, trafficking,

distribution, processing, extraction, sale and/or possession of

cannabis, marijuana or related substances or products containing or

relating to the same, including, but not limited to, the

prohibition on drug trafficking under 21 U.S.C. § 841(a), et

seq., the conspiracy statute under 18 U.S.C. § 846, the bar

against aiding and abetting the conduct of an offense under 18

U.S.C. § 2, the bar against misprision of a felony (concealing

another’s felonious conduct) under 18 U.S.C. § 4, the

bar against being an accessory after the fact to criminal conduct

under 18 U.S.C. § 3, and federal money laundering statutes

under 18 U.S.C. §§ 1956, 1957, and 1960 (the

“Federal Cannabis

Laws”).

“Loan” is defined in the

recitals of this Agreement and is evidenced by this Agreement, the

Note and other Loan Documents.

“Loan Documents” means,

collectively, this Agreement, the Assignment of Rents and Leases,

the Note, the Security Instrument, the Pledge Agreement, the

Subordination Agreement, the Guaranty Agreement and the

Environmental Indemnity Agreement, together with any and all other

documents executed by Borrower, any other Loan Party, and Guarantor

or others evidencing, securing or otherwise relating to the

Loan.

“Loan Obligations” means

the aggregate of all principal and interest owing from time to time

under the Note and the other Loan Documents and all expenses,

charges and other amounts from time to time owing under the Note,

this Agreement, or the other Loan Documents and all covenants,

agreements and other obligations from time to time owing to, or for

the benefit of Lender pursuant to the Loan Documents.

“Loan Party” means

Borrower, Guarantor and Operator, individually, and

“Loan

Parties” means Borrower, Guarantor, and Operator,

collectively.

“Material Adverse Effect”

means any change, event or development that has caused, or would

reasonably be expected to cause, a material adverse change in (i)

the value, operations, financial or physical condition of the

Property, or (ii) the business, financial condition or results

of operations of Borrower or Guarantor and its consolidated

subsidiaries, taken as a whole, such that the ability of Borrower

(or Guarantor pursuant to the Guaranty Agreement) to repay the Loan

has been or would reasonably be expected to be materially

impaired.

“Maturity

Date” means June 29, 2026, or such other date on which

the final payment of principal of the Note becomes due and payable

as therein or herein provided, whether at such stated maturity

date, by declaration of acceleration, or otherwise.

“Money” means all monies,

cash, rights to deposit or savings accounts or other items of legal

tender obtained from or for use in connection with the operation of

the Property.

“Monthly Principal

Payment” is defined in Section 2.1(c)(ii).

“Mortgaged

Property” means the

Property, the Improvements thereon and all real or personal

property owned by the Borrower and encumbered by a Security

Instrument, together with all tangible or intangible rights

pertaining to the Property and Improvements, as more particularly

defined in the Security Instrument as the “Mortgaged

Property”.

“Note” means the

Promissory Note of even date herewith from Borrower to Lender in

the principal amount of the Loan payable by Borrower to the order

of Lender, including all schedules, riders, allonges, endorsements,

addenda or amendments together with any renewals, replacements,

substitutions or extensions thereof.

“Operator” means Cypress

Manufacturing Company, a California corporation.

“Parent”

means Lowell Farms Inc., a British Columbia, Canada corporation and

the owner of 100% of the outstanding voting stock of

Guarantor.

“Patriot Act” is defined

in Section

9.14(a).

“Payment Reserves” means

the Debt Reserve and any other escrow or reserve fund established

pursuant to the Loan Documents.

“Permits”

means all licenses, permits, franchises, certificates of occupancy,

consents and other approvals used or necessary in connection with

the ownership, operation, use or occupancy of the Property and/or

the Facility thereon, including, without limitation, (A) to enable

the operation of the Business at the Property in accordance with

all State of California and Monterey County Permits (including

cannabis Permits), and (B) to facilitate the approval of the

transfer of ownership of the Property to Borrower in accordance

with applicable State of California and Monterey County

law.

“Permitted Encumbrances”

means (a) the lien of current real property taxes, water charges,

sewer rents and assessments not yet due and payable; (b) the items

specified in Exhibit D; (c) the exceptions (general and specific)

and exclusions set forth in the Title Policy; (d) other matters to

which like properties are commonly subject; (e) the rights of

tenants (as tenants only) under leases (including subleases)

pertaining to the related Mortgaged Property which the Loan

Documents do not require to be subordinated to the lien of the

Security Instrument; and (f) if the Loan is cross-collateralized

with another loan or loans, the lien of the security instrument for

such other loan(s), provided that none of such items (a), (b), (d)

and (e), individually or in the aggregate, materially interferes

with the current use or operation of the Mortgaged Property or the

security intended to be provided by the Security Instrument or the

Borrower’s ability to pay its obligations when they become

due.

“Permitted Transfer”

means, any one or a series of Transfers of direct or indirect

ownership interests in any Restricted Person and/or Guarantor, so

long as (a) such Transfer shall not result in the change of control

by Parent of Borrower, Spence Rd, Operator or Guarantor such that

the Parent does not control, directly or indirectly, the direction

of the management and policies of each of Borrower, Spence Rd,

Operator and Guarantor, (b) following such Transfer, each of

Borrower, Spence Rd and Operator shall be wholly owned, directly or

indirectly, by Guarantor, (c) such Transfer shall not result in any

violation, revocation or suspension of any Facility License or any

other material Permit necessary to operate the Business, (d) Lender

receives at least thirty (30) days’ prior written notice

thereof together with an organizational chart reflecting the

ownership interests in Borrower, Spence Rd and/or Operator

following consummation of such transfer; and (e) to the extent

reasonably required by Lender, the assignee of such Transfer

satisfiers Lender’s customary

“know-your-customer” and anti-money laundering

requirements.

“Person” means any natural

person, firm, trust, corporation, partnership, limited liability

company, trust and any other form of legal entity.

“Pledge Agreement” means

that certain Ownership Pledge, Assignment and Security Agreement

made as of the date hereof by and between the Borrower and Lender

pursuant to which the Spence Rd Equity is being pledged to the

Lender as Collateral for the Loan Obligations.

“Proceeds”

means all awards, payments, earnings, royalties, issues, profits,

liquidated claims, and proceeds (including proceeds of insurance

and condemnation or any conveyance in lieu thereof) from the sale,

conversion (whether voluntary or involuntary), exchange, transfer,

collection, loss, damage, condemnation, disposition, substitution

or replacement of any of the Collateral.

“Prohibited Activities and

Conditions” is defined in Section 6.1.

“Property” means the real

estate located at 20800 Spence Road, Salinas, California 93908,

which is more particularly described in Exhibit A hereto, upon which

the Facility is located, and which, concurrent with the Closing

Date, will be owned by the Borrower and leased to the Operator

pursuant to the Lease Agreement.

“Purchase

Agreement” means that certain Purchase Agreement by

and among Borrower, as purchaser, Lowell Farms Inc., a British

Columbia corporation, Michael Gregory, C Quadrant LLC, a California

limited liability company (“C Quadrant”), AMAG

Holdings, LLC, a Wyoming limited liability company

(“AMAG” and, together with C Quadrant,

“Sellers,” and each, a “Seller”),

thereunder, as the same may be amended, restated, supplemented or

otherwise modified and in effect from time to time.

“Remedial Work” is defined

in Section

6.8.

“Rents” means all rent and

other payments to Borrower of whatever nature from time to time

payable pursuant to the Lease Agreement, including deposits

(whether for security or otherwise but excluding any resident trust

accounts), issues, profits, revenues, royalties, rights, benefits,

and income of every nature of and from the Property and the

operations conducted or to be conducted thereon.

“Restricted Person” means

each of Borrower, Operator and Spence Rd.

“Security Instrument”

means that certain Deed of Trust, Assignment of Leases and Rents,

Security Agreement, and Fixture Filing of even date herewith from

Borrower in favor of and for the benefit of Lender and covering the

Mortgaged Property described herein as the same may be amended,

restated, replaced, subleased or modified from time to

time.

“Single Purpose Entity”

means a Person which owns no interest or property other than the

Property, the Improvements, the Equipment, the Spence Rd Equity and

property interests incidental to the foregoing.

“Spence Rd” means 20800

Spence Rd LLC, a California limited liability company.

“Spence Rd Equity” means

the outstanding limited liability company interests in Spence

Rd.

“Stock” means all shares,

options, warrants, general or limited partnership interests,

membership interests, participations or other equivalents

(regardless of how designated) in a corporation, limited liability

company, partnership or any equivalent entity, whether voting or

nonvoting, including, without limitation, common stock, preferred

stock, or any other “equity security” (as such term is

defined in Rule 3a11-1 of the General Rules and Regulations

promulgated by the Securities and Exchange Commission under the

Securities Exchange Act of 1934, as amended).

“Subordination Agreement”

means that certain Subordination and Attornment Agreement of even

date herewith by and among Borrower, Operator and

Lender.

“Survey”

is defined in Section

2.4(c).

“Taxes” means all taxes,

assessments, vault rentals and other charges, if any, general,

special or otherwise, including all assessments for schools, public

betterments and general or local improvements, which are levied,

assessed or imposed by any public authority or quasi-public

authority, and which, if not paid, will become a lien, on the Land

or the Improvements.

“Term” means the date

hereof through the Maturity Date, as the same may be extended, or

earlier termination of the Loan.

“Title

Policy” is defined

in Section

2.4(c).

“Transfer” means the

conveyance, assignment, sale, transfer, granting of options with

respect to or other disposition of (directly or indirectly,

voluntarily or involuntarily, by operation of law or otherwise, and

whether or not for consideration or of record) (collectively,

“Disposition”), or the

creation of a Lien with respect to, all or any portion of any legal

or beneficial interest (i) in all or any portion of the Mortgaged

Property or any other real or personal property of the Borrower or

Spence; (ii) in the Stock of any corporation which is a Restricted

Person, a member of a Restricted Person (if the Restricted Person

is a limited liability company), a partner of a Restricted Person

or, if applicable, a partner of a general partner of a Restricted

Person (if the Restricted Person is a limited or general

partnership), including any legal or beneficial interest in any

constituent limited partner or member of the Restricted Person;

(iii) in a Restricted Person (or any trust of which the Restricted

Person is a trustee); or (iv) if a Restricted Person is a joint

venture, trust, nominee trust, tenancy in common or other

unincorporated form of business association or form of ownership

interest, in any Person having a direct or indirect legal or

beneficial ownership in the Restricted Person, whether directly or

through multiple tiers of ownership. The term “Transfer” shall also

include, without limitation, the following: (a) an installment

sales agreement wherein a Restricted Person agrees to sell the

Mortgaged Property or any other real or personal property

constituting a portion of the Collateral, or any part thereof or

any interest therein, for a price to be paid in installments; (b)

an agreement by a Restricted Person leasing all or a substantial

part of the Mortgaged Property or any other Collateral to one or

more Persons pursuant to a single transaction or related

transactions (other than the Lease Agreement), or (c) a sale,

assignment or other transfer of, or the grant of a security

interest in, a Restricted Person’s right, title and interest

in and to the Leases or the Rents; (d) any instrument subjecting

the Mortgaged Property to a condominium regime or transferring

ownership to a cooperative corporation or other form of multiple

ownership or governance; or (e) the issuance of new Stock in any

corporation which is a Restricted Person.

Notwithstanding

anything to the contrary contained herein, (x) no Disposition of

direct or indirect ownership interests in Parent or any direct or

indirect subsidiary of Parent (other than a Restricted Person or

Guarantor) shall constitute a “Transfer” for purposes

of this Agreement or the other Loan Documents; provided that, in

connection with any consolidation, merger or sale of all or

substantially all of the assets of Parent, (a) Borrower shall have

provided Lender with (i) not less than fifteen (15) Business

Days’ prior written notice of such consolidation, merger or

sale, together with a description thereof, and (ii) such

information as is necessary to satisfy Lender’s customary

“know-your-customer” requirements for any such

transferee, and (b) Borrower, Guarantor and Spence Rd shall execute

such documentation as Lender reasonably requires confirming the

continued validity and effectiveness of the Loan Documents

including, without limitation, any affirmation and/or assumption of

the Guaranty and Environmental Indemnity that Lender may reasonably

require, (y) neither (a) the creation of a Lien on (i) the Stock or

other ownership interests in any Person other than Borrower or

Spence Rd or (ii) any assets (other than Stock or other ownership

interests in Borrower or Spence Rd) of a Person other than Borrower

or Spence Rd, (b) the creation of a Permitted Encumbrance nor (c)

the existence or creation of a Lien that is being contested in

compliance with Section

5.2 shall constitute a “Transfer” for purposes

of this Agreement or the other Loan Documents; and (z) no

Disposition of any assets of a Person other than Borrower or Spence

Rd (other than Stock or other ownership interests in a Restricted

Person) shall constitute a “Transfer” for purposes of

this Agreement or the other Loan Documents.

1.2 Singular and Plural Forms.

Singular terms shall include the plural forms and vice versa, as

applicable, of the terms defined. Unless otherwise specified, all

meanings attributed to defined terms herein shall be equally

applicable to both the singular and plural forms of the terms so

defined. All references to a defined term that includes more than

one written instrument, document, agreement or thing means and

includes each document, agreement or thing encompassed within the

defined term.

1.3 UCC Definitions. Terms

contained in this Agreement shall, unless otherwise defined herein

or unless the context otherwise indicates, have the meanings, if

any, assigned to them by the Uniform Commercial Code in effect in

the State of California.

1.4 Accounting Terms. All

accounting terms used in this Agreement shall be construed in

accordance with GAAP, except as otherwise specified.

1.5 Amendments, Etc. All references

to other documents or instruments shall be deemed to refer to such

documents or instruments as they may hereafter be extended,

renewed, modified, or amended and all replacements and

substitutions therefore.

1.6 Laws, Etc. Any reference to a

code, act, statute or regulation means that law, code, act, statute

or regulation as amended or supplemented from time to time and any

corresponding provisions of successor laws, codes, acts, statutes

or regulations and any reference to any law, code, act or statute

shall be deemed also to refer to all rules and regulations

promulgated thereunder, unless the context requires

otherwise.

ARTICLE

II

TERMS

OF THE LOAN

2.1 The Loan. Borrower agrees to

borrow the Loan from Lender, and Lender agrees to make the Loan to

Borrower, subject to Borrower’s compliance with and

observance of the terms, conditions, covenants, and provisions of

this Agreement and the other Loan Documents, and Borrower has made

the covenants, representations, and warranties herein and therein

as a material inducement to Lender to make the Loan.

(a) Loan. On the Closing Date,

Lender shall make a Loan to Borrower in the amount of Nine Million

Three Hundred Sixty and No/100 Dollars ($9,360,000.00). The

proceeds of the Loan shall be used to acquire the Property, to fund

the Debt Reserve and to pay closing costs and fees.

(b) Interest.

(i) Except as otherwise

provided in this Agreement, the unpaid principal amount of the Loan

and any interest not paid within 30 days of the due date, shall

bear interest with respect to so much of the principal amount of

the Loan outstanding for a calendar month, at the Interest

Rate.

(ii) Interest

on the unpaid principal amount of the Loan shall be payable monthly

in arrears commencing on the first day of the first full calendar

month following the calendar month in which the Disbursement Date

occurs, and on the first day of each month thereafter until the

principal, together with all interest and other charges payable

with respect to the Loan, shall be fully paid; and

(iii) calculated on the basis of a 360 day year and the actual

number of days elapsed. Interest not paid within 30 days after the

due date shall accrue like interest as principal and shall be

immediately payable.

(iii) All

agreements among Borrower and Lender are expressly limited, so that

in no event or contingency, whether because of the advancement of

the Loan, acceleration of maturity of the unpaid principal balance,

or otherwise, shall the amount paid or agreed to be paid to Lender

for the use, forbearance, or retention of the money to be advanced

under this Agreement or any Loan Document exceed the highest lawful

rate permissible under applicable usury laws. If, under any

circumstances, fulfillment of any provision of the Loan, this

Agreement, the other Loan Documents or any other agreement

pertaining to the Loan, after timely performance of such provision

is due, shall involve exceeding the limit of interest validity

prescribed by law that a court of competent jurisdiction deems

applicable, then, ipso

facto, the obligations to be fulfilled shall be reduced to

the limit of such validity. If, under any circumstances, Lender

shall ever receive as interest an amount that exceeds the highest

lawful rate, the amount that would be excessive interest shall be

applied to reduce the unpaid principal balance of the Loan and not

to pay interest, or, if such excessive interest exceeds the unpaid

principal balance of the Loan, such excess shall be refunded to

Borrower. This provision shall control every other provision of all

agreements among Borrower and

Lender.

(c) Principal.

(i) Maturity Date. The entire

unpaid principal balance of the Loan and all accrued but unpaid

interest and all other charges payable with respect to the Loan

shall be due and payable on the Maturity Date.

(ii) Installment

Payments. On the Amortization Commencement Date and on the

first day of each consecutive calendar month thereafter, Borrower

shall pay to Lender monthly payments of interest together with

monthly payments of principal based on a ten (10) year amortization

schedule in accordance with Exhibit C (each a

“Monthly Principal

Payment”).

(iii) Prepayment.

Borrower may repay all or any portion of the Loan without penalty

at any time, subject to (i) payment of the Exit Fee as provided for

herein, and (ii) any prepayment of any principal amount outstanding

under this Note shall be made together with a prepayment premium in

the following amount, as applicable:

(A) for any prepayment

made during the first (1st) year of the term of the Loan, in amount

equal (a) the sum of all interest that otherwise would be due and

payable on the full principal amount of this Note during the first

(1st) year of the term of the Loan, less (b) accrued interest

previously paid by Borrower during the first (1st) year of the term

of the Loan;

(B) for any prepayment

made during the second (2nd) year of the term of the Loan, four

percent (4%) of the principal amount being prepaid;

and

(C) for any prepayment

made during or after the third (3rd) year of the term of the Loan,

two percent (2%) of the principal amount being prepaid. Any partial

prepayment shall first be applied to accrued and unpaid interest

and then to the outstanding principal balance of the Loan, and no

such partial prepayment shall relieve Borrower of the obligation to

pay any subsequent installment of principal when due.

(iv) Manner

and Time of Payment. All payments of interest, principal and

fees shall be made in lawful money of the United States in

immediately available funds, without counterclaim or setoff and

free and clear of, and without any deduction or withholding for,

any taxes or other payments by wire transfer to Lender to such

account as Lender shall from time to time designate. Payments shall

be credited on the Business Day on which immediately available

funds are received prior to 5:00 P.M. Eastern Standard Time;

payments received after 5:00 P.M. Eastern Standard Time shall be

credited to the Loan on the next Business Day. Payments which are

by check, which Lender may at its option accept or reject, or which

are not in the form of immediately available funds shall not be

credited to the Loan until such funds become immediately available

to Lender, and, with respect to payments by check, such credit

shall be provisional (but shall not result in the accrual of

interest on any interest payment made by such check) until the item

is finally paid by the payor bank.

(v) Application of Payments. Except

to the extent otherwise required by law or by the express terms of

any other Loan Document, Lender shall apply and credit funds

received by Lender pursuant to this Agreement or any other Loan

Document as follows: (a) first, to pay, or reimburse Lender

for amounts advanced by Lender (other than principal of the Loan)

pursuant to any provision of the Loan Documents (including without

limitation those fees, charges, costs and expenses described in

subsections (vi) and (vii) below, (b) second, to pay any

interest earned or accrued, (c) third, to fund any deposits

that Borrower may be required by the terms of any Loan Document to

make with Lender, including any such deposits to be used to pay the

cost of repairing or constructing any improvements, insurance

premiums, Taxes, Payment Reserves (if any), and utility charge,

(d) fourth, to pay any Late Charges due under this Agreement

or any other Loan Document, (e) fifth, to pay any other sums

due under the Loan Documents, and (f) sixth, to pay principal

outstanding; provided, however, that during the continuance of an

Event of Default, Lender shall apply and credit funds in such

manner and order of priority as Lender shall determine in

Lender’s sole discretion.

(vi) Billing.

Lender may submit monthly billings reflecting payments due;

provided, however, that any changes in the interest rate which

occur between the date of billing and the due date may be reflected

in adjustments in the billing for a subsequent month. Neither the

failure of Lender to submit a bill, nor any error in any such bill

shall excuse Borrower from the obligation to make full payment of

all Borrower’s payment obligations when due.

(vii) Default

Rate Interest. In the event that any Event of Default shall

occur and remaining continuing for a period of 30 days, any unpaid

principal, accrued interest, Late Charges and other amounts payable

under this Agreement or any other Loan Document shall bear

interest, compounded monthly, at the Default Rate; provided, however, that if collection

from Borrower of interest at such rate would be contrary to

applicable law, then such amounts shall bear interest at the

highest rate which may be collected from Borrower under applicable

law.

(viii) Late

Charge. If any payment (whether of fees, interest or

principal but excluding the payment due on the Maturity Date or

upon any acceleration of the Loan) is not paid within five (5)

Business Days of the date on which the payment is due, Borrower

shall pay to Lender in addition to the delinquent payment and

without any requirement of notice or demand by Lender except as may

be imposed by law, a “Late Charge” equal to five percent (5%) of the

amount of the delinquent payment. Late Charges are (a) payable

in addition to, and not in limitation of, the Default Rate;

(b) intended to compensate Lender for administrative and

processing costs incident to late payments; (c) not interest;

and (d) not subject to refund or rebate or credit against any

other amount due. Borrower expressly acknowledges and agrees that

this Late Charges provision is reasonable under the circumstances

existing on the date of this Agreement, which it would be extremely

difficult and impractical to fix Lender’s actual damages

arising out of any late payment and that the Late Charge shall be

presumed to be the actual amount of such damages incurred by

Lender. In addition, in the event that any loan payment check

tendered by Borrower to Lender is not honored upon presentment for

demand, Borrower shall pay to Lender upon demand an amount equal to

Two Hundred Fifty Dollars ($250.00). No provision in this Agreement

(including the provisions for Late Charges and for additional

interest on any amounts remaining unpaid after the Maturity Date)

shall be construed as in any way excusing Borrower from its

obligation to make each payment promptly when due.

2.2 Security for the Loan. The Loan

will be evidenced, secured and guaranteed by the Loan

Documents.

2.3 Origination Fee; Transaction

Costs. On the Closing Date, Borrower shall pay to Lender

from the proceeds of the Loan an origination fee in an amount equal

to Three Hundred Sixty Thousand Dollars ($360,000.00); and Borrower

shall have paid or reimbursed Lender for all title insurance

premiums, recording and filing fees, costs of environmental

reports, physical condition reports, appraisals and other reports,

the reasonable fees and costs of Lender’s counsel and all

other third party out of pocket expenses incurred in connection

with the origination of the Loan. The origination fee shall be

deemed to be fully earned upon the earlier to occur of (a) issuance

of any commitment letter, or (b) the Closing Date, and shall be

non-refundable upon payment.

2.4 Conditions Precedent to

Closing. The obligation of Lender to make the Loan hereunder

is subject to the fulfillment by Borrower or waiver by Lender of

the following conditions precedent no later than the Closing

Date:

(a) Representations and Warranties;

Compliance with Conditions. The representations and

warranties of Borrower and other Loan Parties, as applicable,

contained in this Agreement and the other Loan Documents shall be

true and correct in all material respects on and as of the Closing

Date with the same effect as if made on and as of such date, and no

Default or an Event of Default shall have occurred and be

continuing; and Borrower shall be in compliance in all material

respects with all terms and conditions set forth in this Agreement

and in each other Loan Document on its part to be observed or

performed.

(b) Loan Agreement and Note. Lender

shall have received a copy of this Agreement and the Note, in each

case, duly executed and delivered on behalf of

Borrower.

(c) Delivery of Loan Documents; Title

Insurance; Reports; Leases.

(i) Security Instrument, Assignment of

Leases. Lender shall have received from Borrower and

Operator, as applicable, fully executed and acknowledged

counterparts of the Security Instrument, the Subordination

Agreement and the Assignment of Leases and evidence that

counterparts of the Security Instrument, the Subordination

Agreement and Assignment of Leases have been delivered to the title

company for recording, in the reasonable judgment of Lender, so as

to effectively create upon such recording valid and enforceable

Liens upon the Property, of the requisite priority, in favor of

Lender (or such other trustee as may be required or desired under

local law), subject only to the Permitted Encumbrances. Lender

shall have also received from each Loan Party, as applicable, fully

executed counterparts of the other Loan Documents.

(ii) Title

Insurance. Lender shall have received title insurance

policies issued by a title company acceptable to Lender and dated

as of the Closing Date, or a commitment to issue a policy with

title insurance (either in the form of a commitment or pro forma

policy) (the “Title

Policy”). The Title Policy shall (i) provide coverage

in amounts reasonably satisfactory to Lender, (ii) insure Lender

that the Security Instrument creates a valid first priority lien on

the Property encumbered thereby of the requisite priority, free and

clear of all exceptions from coverage other than Permitted

Encumbrances, (iii) contain such endorsements and affirmative

coverages as Lender may reasonably request, and (iv) name Lender as

the insured. The Title Policy shall be assignable. Lender also

shall have received evidence that all premiums in respect of the

Title Policy have been paid.

(iii) Survey.

Lender shall have received a current land survey for the Property,

certified to the title company, and Lender and their successors and

assigns, in form and content reasonably satisfactory to Lender and

prepared by a professional and properly licensed land surveyor

satisfactory to Lender in accordance with the Accuracy Standards

for ALTA/NSPS Land Title Surveys as adopted by ALTA, American

Congress on Surveying & Mapping and National Society of

Professional Surveyors in 2021 or such other standard as Lender may

approve in its sole discretion (the “Survey”). The Survey

shall reflect the same legal description contained in the Title

Policy and shall include, among other things, a metes and bounds

description of the real property comprising part of the Property

reasonably satisfactory to Lender. The surveyor’s seal shall

be affixed to the Survey and the surveyor shall provide a

certification for the Survey in form and substance reasonably

acceptable to Lender.

(iv) Insurance.

Lender shall have received valid certificates of insurance and the

endorsements related thereto for the policies required pursuant to

Section

4.5

hereunder, satisfactory to Lender in its sole discretion, and

evidence of the payment of all insurance premiums then due and

owing.

(v) Environmental Reports. Lender

shall have received a Phase I environmental report (and, if

recommended by the Phase I environmental report, a Phase II

environmental report) (collectively, the “Environmental Reports”)

in respect of the Property, in each case reasonably satisfactory in

form and substance to Lender.

(vi) Zoning.

With respect to the Property, Lender shall have received, at

Lender’s option, letters or other evidence with respect to

the Property from the appropriate municipal authorities (or other

Persons) concerning applicable zoning and building laws, in

substance reasonably satisfactory to Lender.

(vii) Encumbrances.

Borrower shall have taken or caused to be taken such actions in

such a manner so that Lender have a valid and perfected first

priority Lien as of the Closing Date with respect to the Security

Instrument on the Property, subject only to applicable Permitted

Encumbrances, and Lender shall have received reasonably

satisfactory evidence thereof.

(viii) Flood

Certificates. Lender shall have received a Flood

Determination Certificate reasonably satisfactory to

Lender.

(d) Related Documents. Each

additional document not specifically referenced herein, but

relating to the transactions contemplated herein, shall be in form

and substance reasonably satisfactory to Lender, and shall have

been duly authorized, executed and delivered by all parties thereto

and Lender shall have received and approved certified copies

thereof.

(e) Delivery of Organizational

Documents. Borrower shall deliver or cause to be delivered

to Lender copies certified by each applicable Loan Party of all

organizational documentation related to each Loan Party and/or the

formation, structure, existence, good standing and/or qualification

to do business, as Lender may request in its sole discretion,

including good standing certificates, qualifications to do business

in the appropriate jurisdictions, resolutions authorizing the

entering into of the Loan, execution and delivery of the Loan

Documents, as applicable, and incumbency certificates as may be

requested by Lender.

(f) Opinions of Borrower’s

Counsel. Lender shall have received opinions from

Borrower’s counsel with respect to the due execution,

authority, enforceability of the Loan Documents and such other

matters as Lender may require, all such opinions in form, scope and

substance satisfactory to Lender and Lender’s counsel in

their reasonable discretion.

(g) Basic Carrying Costs. Borrower

(or other Persons) shall have paid all basic carrying costs

relating to the Property which are in arrears, if any, including

without limitation, (i) accrued but unpaid insurance premiums, (ii)

currently due Taxes (including any in arrears) and (iii) currently

due other charges, which amounts shall be funded with proceeds of

the Loan.

(h) Completion of Proceedings. All

corporate and other proceedings taken or to be taken in connection

with the transactions contemplated by this Agreement and other Loan

Documents and all documents incidental thereto shall be reasonably

satisfactory in form and substance to Lender, and Lender shall have

received all such counterpart originals or certified copies of such

documents as Lender may reasonably request.

(i) Payments. All Payment Reserves,

payments, deposits or escrows required to be made or established by

Borrower under this Agreement, the Note and the other Loan

Documents on or before the Closing Date shall have been

paid.

(j) Intentionally

Omitted.

(k) Material Adverse Change. There

shall have been no material adverse change in the financial

condition or business condition of any Loan Party or the Property

since the date of the most recent financial statements delivered to

Lender. The income and expenses of the Property, the occupancy

thereof, and all other features of the transaction shall be as

represented to Lender without material adverse change. No Loan

Party nor any of its constituent Persons shall be the subject of

any bankruptcy, reorganization, or insolvency

proceeding.

(l) Lease. Lender shall have

received a fully executed copy of the Lease Agreement, which shall

be satisfactory in form and substance to Lender.

(m) Tenant Estoppels. Lender shall

have received an executed estoppel letter, which shall be in form

and substance satisfactory to Lender, from Operator under the Lease

Agreement.

(n) Subordination and Attornment.

Lender shall have received appropriate instruments acceptable to

Lender subordinating the Lease Agreement designated by Lender to

the Security Instrument. Lender shall have received an agreement to

attorn to Lender satisfactory to Lender from any tenant under a

Lease that does not provide for such attornment by its

terms.

(o) Tax Lot. Lender shall have

received evidence that the Property constitutes one (1) or more

separate tax lots, which evidence shall be reasonably satisfactory

in form and substance to Lender.

(p) Physical Condition Reports.

Lender shall have received physical condition reports with respect

to the Property, which reports shall be reasonably satisfactory in

form and substance to Lender.

(q) Intentionally

Omitted.

(r) Appraisal. Lender shall have

received an appraisal of the Property, which shall be satisfactory

in form and substance to Lender.

(s) Acquisition. The acquisition of

the Property, the Facility and related assets shall have been

completed and consummated as contemplated by the Purchase

Agreement, all on terms and conditions reasonably satisfactory to

Lender.

(t) Intentionally

Omitted.

(u) Further Documents. Lender or

its counsel shall have received such other and further approvals,

opinions, documents and information as Lender or its counsel may

have reasonably requested including the Loan Documents in form and

substance satisfactory to Lender and its counsel.

ARTICLE

III

BORROWER’S

REPRESENTATIONS AND WARRANTIES

To induce Lender to enter into this

Agreement, and to make the Loan to Borrower, Borrower represents

and warrants to Lender as follows:

3.1 Existence, Power and

Qualification. Borrower is a duly organized and validly

existing limited liability company, has the power to own or lease

its properties and to carry on its business as is now being

conducted, and is duly qualified to do business and is in good

standing in every jurisdiction in which the character of the

properties owned or leased by it or in which the transaction of its

business makes qualification necessary. Operator is a duly

organized and validly existing corporation, has the power to own or

lease its properties and to carry on the Business, and is duly

qualified to do business and is in good standing in every

jurisdiction in which the character of the properties owned or

leased by it or in which the transaction of its business makes its

qualification necessary.

3.2 Power and Authority. Borrower

has full power and authority to borrow the Indebtedness evidenced

by the Note and to incur the Loan Obligations provided for herein,

all of which have been authorized by all proper and necessary

action. All consents, approvals authorizations, orders or filings

of or with any court or Governmental Authority, if any, required

for the execution, delivery and performance of the Loan Documents

by any Loan Party have been obtained or made. Each Loan Party has

the full power and authority to incur liabilities and obligations

provided for in the respective Loan Documents to which it is a

party, all of which have been authorized by all proper and

necessary action. All consents, approvals authorizations, orders or

filings of or with any court or Governmental Authority, if any,

required for the execution, delivery and performance of the Loan

Documents by each Loan Party have been obtained or

made.

3.3 Due Execution and Enforcement.

Each of the Loan Documents to which a Loan Party is a party

constitutes a legal, valid and binding obligation of the Loan

Party, enforceable in accordance with its respective terms (except

as such enforcement may be limited by bankruptcy, insolvency,

fraudulent transfer, reorganization or other similar laws affecting

the enforcement of creditors’ rights generally and by general

principles of equity) and does not violate, conflict with, or

constitute any default under any law, government regulation,

decree, judgment, the Loan Party’s articles of organization

or incorporation, partnership agreement/operating agreement or

by-laws, as applicable, or any other material agreement or

instrument binding upon the Loan Party. There is no valid offset,

defense, counterclaim or right of rescission available to Borrower

with respect to any of the Loan Documents.

3.4 Single Purpose Entity. Borrower

is a Single Purpose Entity.

3.5 Pending Matters.

(A) Operations; Financial

Condition. No action or investigation is pending or, to

Borrower’s knowledge, threatened before or by any court or

administrative agency which could reasonably be expected to result

in any material adverse change in the financial condition,

operations of a Loan Party. No Loan Party, to its knowledge, is in

violation of any agreement, the violation of which could reasonably

be expected to have a material adverse effect on its business or

assets. No Loan Party, to its knowledge, is in violation of any

order, judgment, or decree of any court, or any statute or

governmental regulation to which it is subject.

(B) Property Improvements. There

are no proceedings pending or, to Borrower's knowledge, threatened

in writing to acquire through the exercise of any power of

condemnation, eminent domain or similar proceedings any part of the

Property, the Improvements or any interest therein, or to enjoin or

similarly prevent or restrict the use of the Property or the

operation of any of the Facility in any material manner. None of

the Improvements is subject to any unrepaired casualty or other

damage.

3.6 Financial Statements Accurate.

All financial statements heretofore or hereafter provided by or on

behalf of each Loan Party are and will be true and complete in all

material respects as of their respective dates and fairly present

in all material respects the respective financial condition of such

Loan Party as of such date, and there are no material liabilities,

direct or indirect, fixed or contingent, as of the respective dates

of such statements that would be required to be reflected therein

or in the notes thereto under GAAP and which are not reflected

therein or in the notes thereto or in a written certificate

delivered with such statements. The financial statements of each

Loan Party have been and will be prepared in accordance with GAAP.

There has been no material adverse change in the financial

condition, or operations of any Loan Party since the dates of such

statements previously delivered except as fully disclosed in

writing with the delivery of such statements. All financial

statements of the operations of the Facility hereafter provided to

Lender will be true and complete in all material respects as of

their respective dates, and to Borrower’s knowledge, all such

financial statements provided to Lender shall be true and correct

in all material respects.

3.7 Compliance with Facility

Laws.

(a) Borrower, Spence Rd

and Operator, as applicable, are the lawful holders of all Permits

for the Facility, all of which (i) are in full force and

effect; (ii) constitute all of the Permits required for the

use, operation and occupancy thereof; (iii) have not been

pledged as collateral for any other loan or Indebtedness;

(iv) are held free from restrictions or any encumbrance which

would materially adversely affect the use or operation of the

Facility; and (v) are not provisional, probationary or

restricted in any way.

(b) To Borrower’s

knowledge after due inquiry, Borrower Operator and the operation of

the Facility and the Business are in compliance in all material

respects with the applicable Limited

Governmental Requirements. No waivers of any laws, rules,

regulations, or requirements are required for the Facility to

operate as a cannabis drying, trimming, packaging and processing

facility.

3.8 Governmental Proceedings and

Notices. Loan Parties have received no notice of, and to

Borrower’s knowledge, neither Borrower, the Operator nor the

Facility is currently the subject of any proceeding by any

Governmental Authority and no written notice of any violation has

been received from a Governmental Authority that would, directly or

indirectly, or with the passage of time, (i) have a material

adverse impact on Operator’s ability to operate the Business,

or (ii) modify, limit or annul or result in the transfer,

suspension, revocation or imposition of probationary use of any of

the Permits.

3.9 Pledges of Accounts. Borrower

has not pledged its Accounts as collateral security for any loan or

Indebtedness other than the Loan.

3.10 Payment

of Taxes and Property Impositions. Each Loan Party has filed

all federal, state, and local tax returns which it is required to

file and has paid, or made adequate provision for the payment of,

all taxes which are shown pursuant to such returns or are required

to be shown thereon or to assessments received by any Loan Party.

All such returns are complete and accurate in all respects.

Borrower has paid or made adequate provision for the payment of all

applicable Taxes, governmental assessments and other outstanding

governmental charges (including, without limitation, water and

sewer charges) and ground rents (if applicable) due with respect to

the Property.

3.11 Title

to Collateral. Borrower has good and marketable title to the

Mortgaged Property described in the Security Instrument executed by